Gas-Fired Intelligence, Part 2

In the showdown between AI and LNG: who gets the gas?

| America | Tech | Opinion | Culture | Charts |

Today, we have the second half of a double-feature special: everything you need to know about the US natural gas industry that’s powering Artificial Intelligence. If you missed it, you can read part 1 here.

We’re currently in the middle of not one, but two generational capex booms: one into LNG export terminals that aim to reshape global energy security, the other into AI datacenters and their insatiable demand for power. Once again, we have Michael Spyker of HTM Energy with a guest piece to help us understand what’s going on.

Yesterday we learned about the gas molecules themselves and how they’re produced. Today, we’re going to dive into power generation, and whether AI’s relentless draw on electricity is on a collision course with LNG exports.

Logically matching load growth with generation: why natural gas is the choice for power demand today

Despite the introduction of the internet, the smartphone, even electric cars – electricity growth in the US has been zero for 20 years. We’ve simply become more efficient in how we consume energy. This “more efficient at scale” theme appears many times throughout the facets of the power market. Despite no demand (also called load) growth, the power market has evolved meaningfully. Gas has replaced coal, and renewables have begun to replace gas. For a mature market with zero growth, that’s how it should be – but we’re not here to discuss a mature market with zero growth.

While there’s admittedly more nuance – the data centers being constructed today should be thought of as true “bottom’s up” baseload demand, and the US should be focused on constructing baseload generation to enable rapid growth in our access to intelligence (and it can even be nuclear, it doesn’t have to be natural gas).

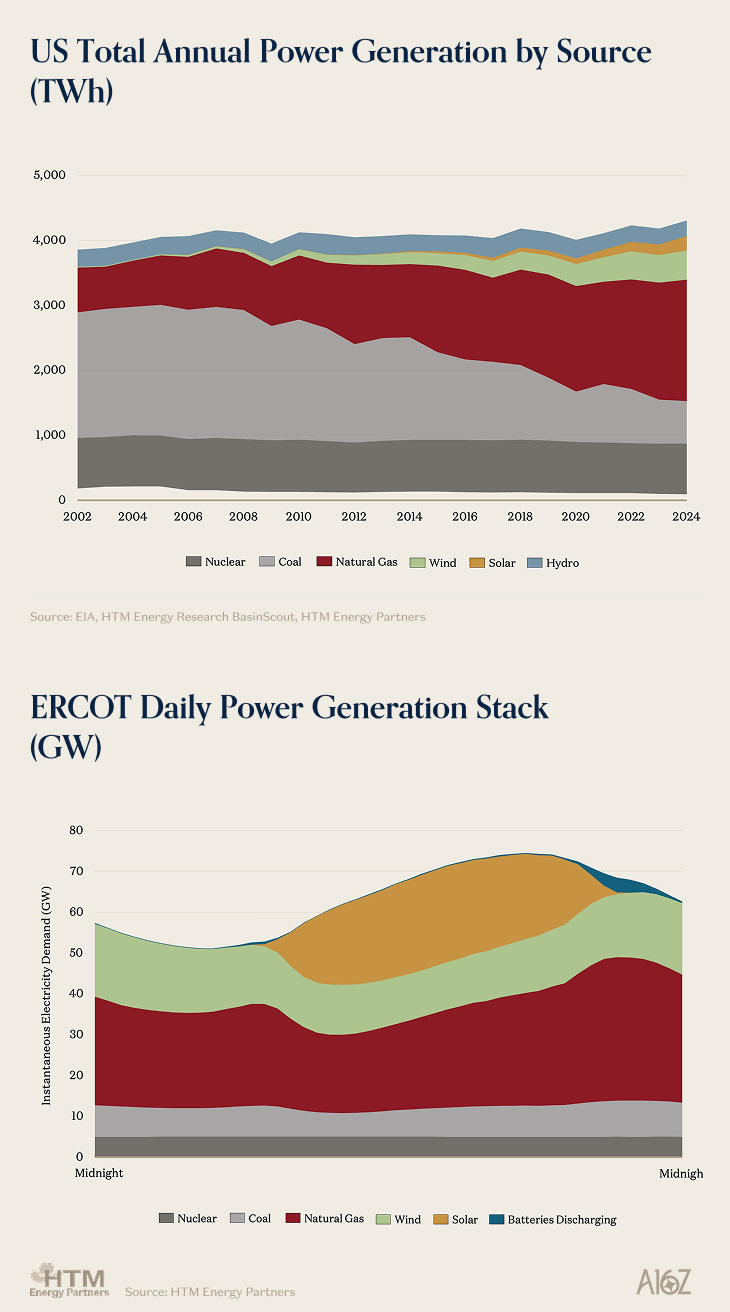

Opposite the future, over the last 20 years, with no load growth in the US, solar and wind have slowly pushed out other baseload power generators; forcing gas generation to curtail itself during the day (shown on the chart below). Because power grids must be built for the peak hour of demand, this means gas generation capacity remains idle in favor of solar, but can’t be structurally consumed without risking the system’s ability to respond to peak demand.

Thus, using the last 20 years of US power markets to draw assumptions about the next decade leads to one logical flaw…

How power generation in the US has evolved since the early-2000s. The left chart shows each generation source’s contribution to annual power produced in the US. The right chart shows how each generation source contributes throughout the day. As the sun rises, solar (yellow) begins to dominate the grid, displacing reliable gas generation. The solar profile is minorly smoothed with batteries (blue), but is clearly not available around the clock as nuclear (orange), coal (grey), and gas (red) are.

But first, we need to appreciate the two kinds of power markets – merchant, and regulated. Merchant markets like ERCOT in Texas are effectively near-perfect expressions of the free market – rely strictly on price signals. In merchant markets power producers are guaranteed nothing, and generators compete against each other in the cash power markets where marginal economics dictate pricing – power producers live and die by their own cost structure. For power producers without purchase agreements (PPAs), marginal economics dictate pricing and being cost competitive in merchant markets is everything – you don’t eat if you can’t economically nominate your electrons into the real-time, or day ahead market. During the day, this means going head-to-head with solar, which has zero marginal cost, and gas can’t even begin to compete. If the market continues to follow price signals, gas generation won’t grow…

In regulated markets, an integrated utility planner focuses on reliability – and is guaranteed a return on equity. In regulated markets, there’s no competition, so price signals don’t dictate what gets built. Instead, effective monopoly utilities build out their preferred resource mix and then petition regulators to rate-base whatever they want to construct. Once approved, every dollar of capital goes into the rate base – regardless of whether the asset is economically competitive or not. In regulated markets, the goal of the central planner is to mimic the outcome of merchant markets (reliability and low-cost), while having, in theory, more ability to control the edge cases and range of pricing outcomes. Regulated markets have continued to grow gas generation, while merchant markets favored solar.

So, many will say that because solar and wind have been the primary addition of generating capacity over the past 10 years, it should be the power of choice going forward. Of course not. Given US power demand has been effectively flat for 20 years, naturally the assets that are being added to the system are zero-marginal-cost generators, as it’s the only way to beat out competition in merchant markets. Without demand growth, a market will begin cannibalizing its higher-cost generation, which ends up being anything with actual cash fuel costs (i.e. natural gas) – chipping away at the marginal producers to optimize itself (effectively, when companies can’t grow their top-line, they chase volatility, which isn’t the winning strategy when top-line needs to grow again). But we’re not in a time of zero demand growth anymore, so discussing cost optimization rather than capacity expansion feels like a useless argument.

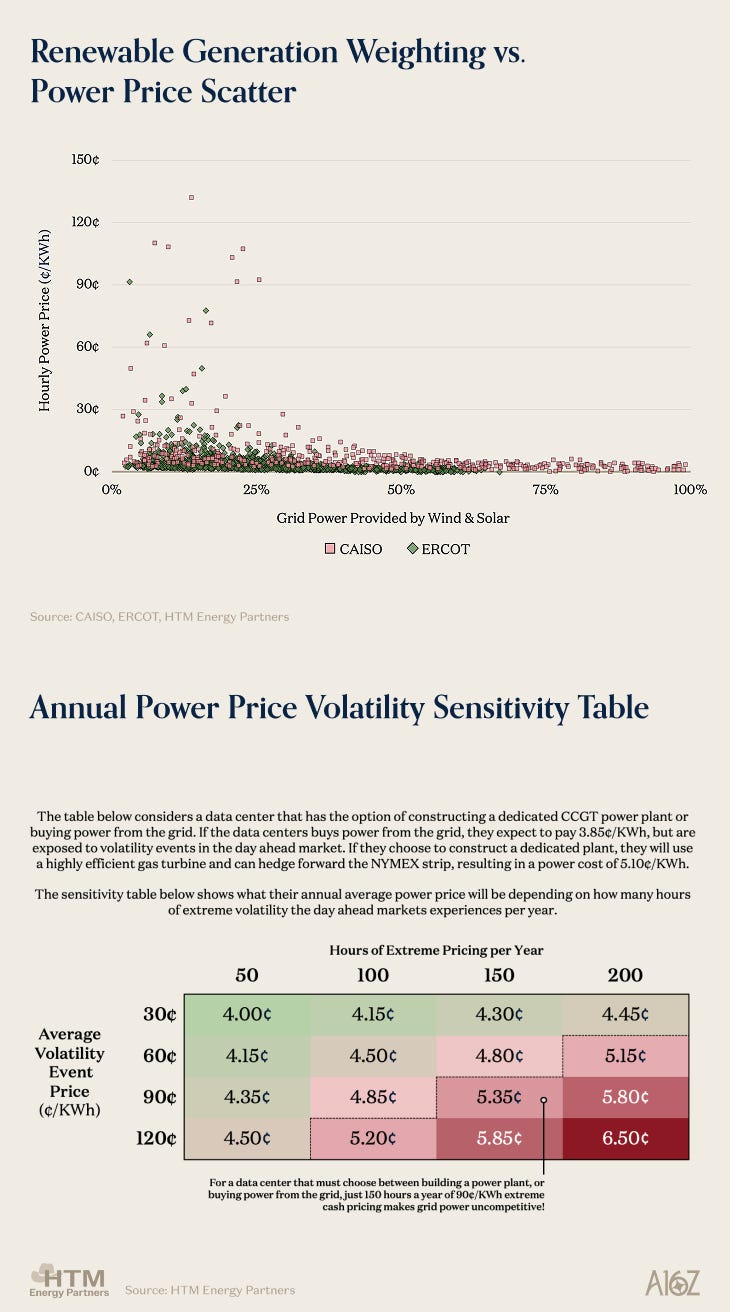

To actually respond to baseload demand growth, solar is not the most effective tool. Solar (in its current state) is inherently less reliable than gas-fired generation, and that’s the end of the story. This isn’t a petition against solar – the opposite – it’s phenomenal and almost certainly the power of the future, just the very long-term future. There’s a reason people are serious about sending data centers into space, but here on earth, we’d only be fooling ourselves if we avoid building gas generation today, rather than mess around and end up building it later. The economics are worse than deploying gas generation at scale (shown on the right table below), and as discussed above, there are still uncontrollable parts of the solar chain which lose out to natural gas. Supplementing a growing grid from the top (solar) rather than the bottom (nuclear/gas) is a losing strategy (vPPAs be damned).

The charts above consider the “edge cost” of relying on intermittent power generation. The left chart shows a scatter where each point is one hour of real grid operation, emphasizing power prices retain massive tail risk to periods of low contributions from wind and solar generation, while the right table considers how much volatility intermittent generation can bear before losing to CCGT LCOE, quantifying the cost & reliability trade offs of grid vs. BTM.

The harsh truth is, renewables shouldn’t even be considered when discussing domestic data centers today – it should be gas or nuclear. When the US began its industrial revolution over a century ago; coal-fired generation answered growth in energy demand. It was abundant, cheap, and allowed the steam engine to become commonplace. Factories, mills and smelters could open anywhere – ultimately the advanced economy the US is today was enabled by the rapid proliferation of low-cost, dispatchable energy at scale.

Over the following century, coal was slowly replaced with natural gas, then renewables. Today, we’re not entering a period of market maturation, it’s a crude expansion, this time with a new type of industrial capability – and natural gas should serve the exact role that coal did a century ago. In many decades from now, when we’ve successfully grown “the pie”, renewable energy, battery storage, and load shifting will slowly refine our future grid, but today we should be focused on expansion. The US has massive natural gas reserves that emulate exactly what coal did – but it means the US has to reign in LNG exports, and that data center developers need to seriously begin planning large facilities with micro-grids on a multi-decade operating outlook (and if you want to get into the environmental footprint, the gas was going to be shipped abroad anyways, restricting LNG exports will force global consumers to adopt renewables; which ends up being a net-positive to global emissions as we avoid the shipping process).

We need more dispatchable, controllable power generation, not intermittent resource. Intermittent generation, like solar, isn’t available all day. Dispatchable generation on the other hand, is controlled by humans (and requires a fuel), but is reliable and knowable. The beauty of intermittent generation is that it generally doesn’t have a material marginal cost per unit. When you install a solar panel, or wind turbine; the “fuel” (sun or wind) doesn’t cost anything, and when the capital is sunk, the cash operating costs are effectively zero. Dispatchable generation on the other hand, has an upfront capital cost, but also incurs cash operating costs. Natural gas, and uranium both cost money – and to generate power, producers must continually buy fuel. Thankfully – natural gas power generation is both incredibly efficient, and the fuel is fairly inexpensive.

Adding battery storage to intermittent generation increases reliability, but because humans don’t control the fuel, it’s not truly dispatchable (yet). For batteries to be truly reliable, they need to be charged with dispatchable power generation (this costs money). Right now, batteries are charged on solar and wind – which are by definition intermittent (and have zero marginal cost). Until battery technology and penetration improve meaningfully, batteries are still intermittent in nature and humans can’t, with near-complete certainty, know how and when batteries can be dispatched over longer periods of time. On a first-principles basis, we think of batteries as increasing both the reliability of solar and wind generation but also increasing the costs of said generation, making them not yet competitive with natural gas (eventually they will be).

See, there’s a large difference between minimizing the lifetime cost of power from a single generating asset, and maximizing the financial returns from a single generating asset. As merchant markets crowd out reliable generation to add assets that effectively seek to capture volatility we don’t think that’s healthy, nor aligned with the trajectory of AI demand growth. You will hear discussions of “grid arbitrage” using batteries (as they can respond almost immediately to high power prices and begin discharging); though for the next 10 years, the US should avoid any scenario where arbitrage like this is possible, as it would mean that capital isn’t pooling into baseload generation, nor have we begun overbuilding power infrastructure (it’s merely increasing the price of intermittent generation next to gas). Certainly the power traders (very grumpy people) will find their way into my inbox and tell me (among other harsh things) why I’m wrong, a failure, an idiot – and how a vPPA is just as good as a PPA and batteries are actually increasing social welfare (saving the turtles too) – we’re not advocating for a system that only build gas-fired generation, rather a system that prefers matching bottoms-up demand with bottoms-up generation as a rule of thumb.

We’ll spend the next decade testing and implementing load management technologies (like what Base Power is doing), and slowly supplement with batteries and renewables, when we’re ready to prune our grid again and grind down our cost per token (much like the gas producers grinded down their own cost structure), we’ll have not already won at AI, but have the tools to keep winning while never risking downtime. Intermittent generation has its place, and it will absolutely play a vital role in the future of how labs serve intelligence. Zero marginal cost power generation will be key in staying at the bottom of the token cost curve; but for the next decade, the implied cost of slowing model breakthroughs because you’re waiting for the sun to rise again, is far greater than the cost of natural gas.

While this is all a fairly idealistic view (especially in merchant markets), as baseload power demand grows from largely price-insensitive consumers (data centers), we expect that a socially-driven focus on holistic grid quality will emerge (optimizing full-cycle and marginal unit costs, along with overall reliability), rather than over-exposing grids to renewables that might only optimize single-asset IRRs (this also means firming existing renewables with batteries). Ultimately, it will be the data center developers that drive this outcome, but as grid power begins to compete with the LCOE of new gas generation, we’d expect (and hope) that a more industrial-revolution first principles type logic prevails (gas is just so good at generating electricity).

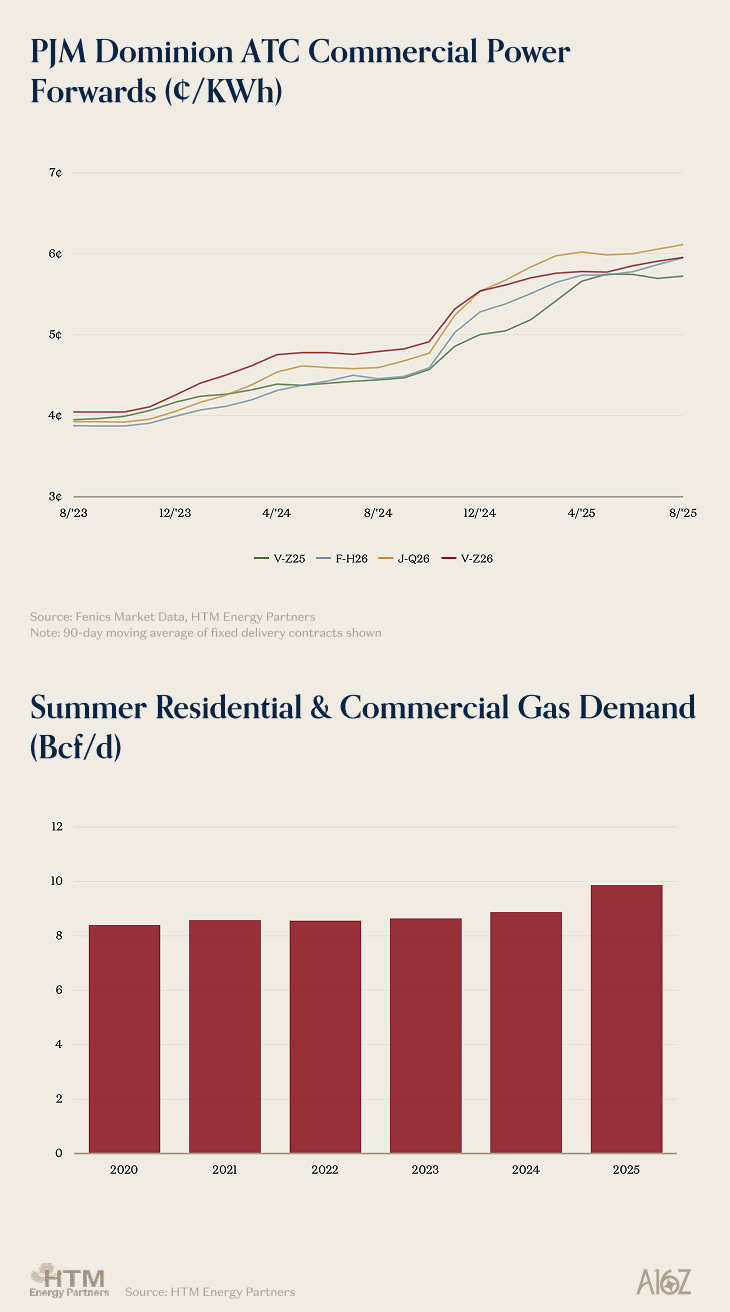

The charts above show the measurable impact of AI on power prices (left), and natural gas consumption (right). For those looking where behind the meter gas consumption shows up, it’ll be in residential and commercial demand – which is up ~1 Bcf/d y/y when adjusted for weather.

For the same reason that LNG terminals like the Permian, data centers love the Permian

As the United States shifts into an era of energy and infrastructure expansion, a pragmatic approach that adds baseload generation (that can be nuclear, or natural gas) will be particularly important to ensuring the reliability of intelligence. In the short-term, this means more baseload growth (we’re going to need it regardless), and in the medium-term, this is supplementing our generation stack with solar, wind, and batteries while optimizing load profiles. The obvious answer, if you’ve read this far, may be “when prices are high, or solar is low, the data center will take itself offline” – which is absolutely the right answer… in the future. But to ignore the opportunity the US has to install vast amounts of power generation capacity that can output power at stupidly low prices, would just be silly.

The data center developers, to some extent, have taken it upon themselves to do exactly that – supplement new load growth with gas generation – and where better to do that than the Permian Basin, the leader in US gas growth.

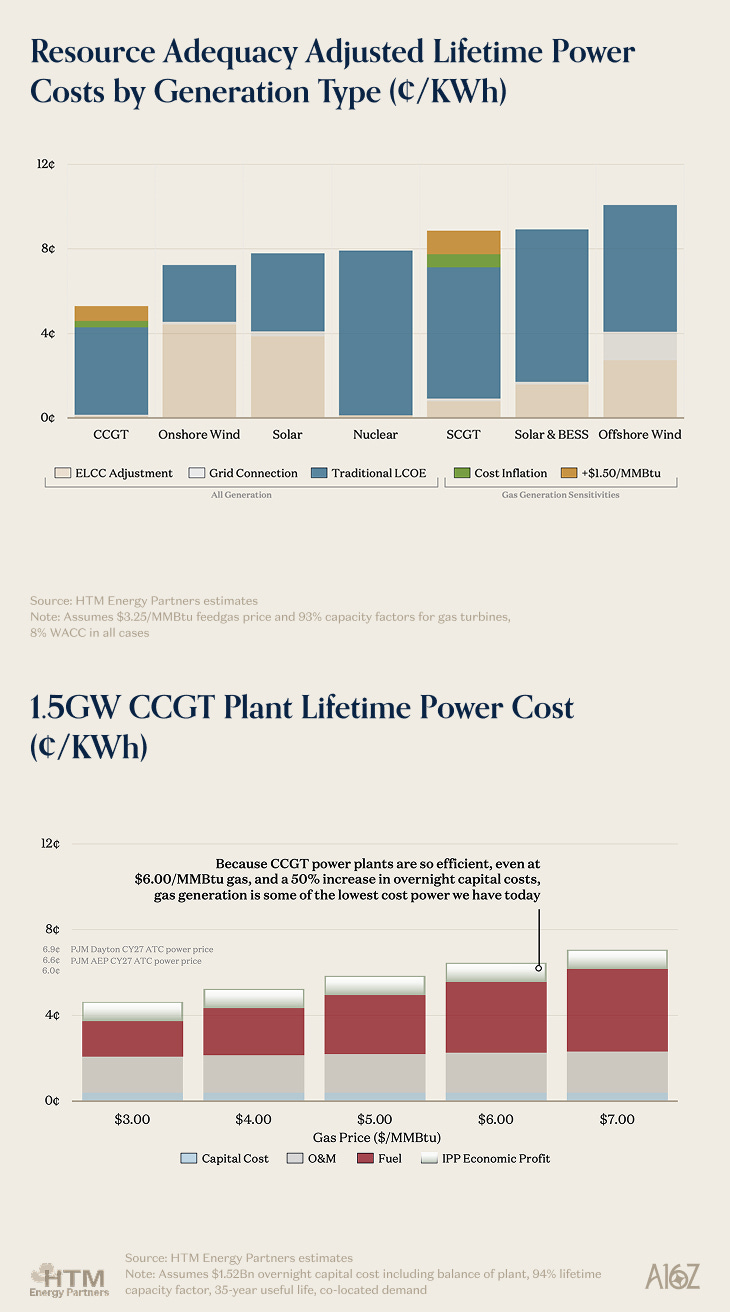

Renewable power is great, because it has almost no marginal cost. This will play an important role in defining AI’s “token cost curve”, but gas generation is fantastic because it’s just so cheap. There’s no other way around it – it’s a known fact today that we can generate electricity at a LCOE of ~5¢/KWh, and with cash costs of ~3.3¢/KWh when using highly efficient combined cycle gas turbines. If gas generating capacity is co-located with the large load it serves, there is nothing that competes with it, even if gas prices begin to increase. It may seem like the fixed ~3.3¢/KWh CCGT cash costs could never compete with the ~0.05¢/KWh cash costs of solar panels – but it does, and that’s because the cash marginal cost of CCGT power (at fixed gas) is always ~3.3¢/KWh, and it’s always there.

The charts above show the average lifetime cost of 1KWh of power by generation type; the left chart compares levelized cost of energy by generation type, but adjusts the traditional LCOE estimate (lifetime costs divided by lifetime energy production) with the cost of transmission, and the implied cost of intermittent generation (i.e. what it would cost to fill gaps in power generation from intermittent sources, with grid power). This adjustment (shown as ‘ELCC Adjustment’) favors dispatchable generation. The right chart shows how lifetime power costs from a large-scale CCGT plant change depending on the price of gas; in our model we base our estimates around a plant configured with 2x GE CC 9HA.02 turbines, and co-located with a data center.

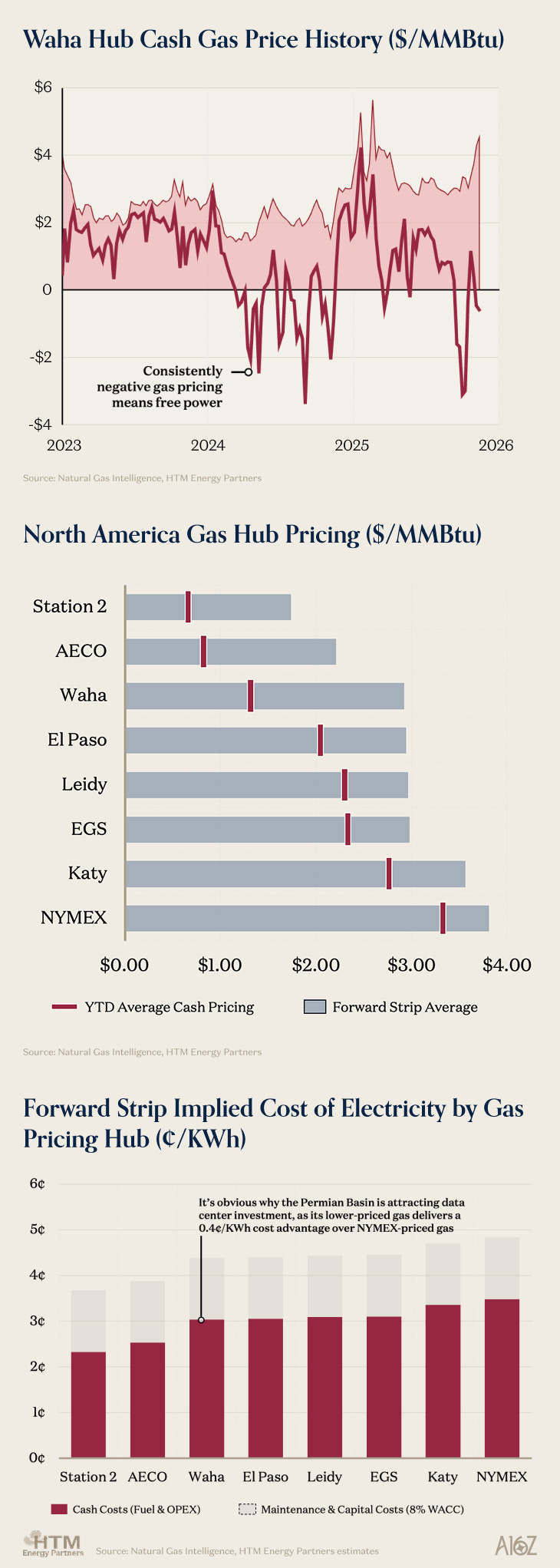

Because the capital cost of the gas turbines themselves make up a tiny part of CCGT’s LCOE, in areas like the Permian Basin, where gas prices have been structurally $2-3/MMBtu cheaper than NYMEX, and are frequently negative – gas-fired power can have negative cash costs, and LCOE can be as low as ~4¢/KWh. So it makes sense why massive AI campuses have chosen wide-open West Texas as their ideal site. Pipelines sprawl throughout the area, land isn’t arable, permitting is easy, and gas is abundant. The only cheaper gas on the continent is in Canada, but who would ever want to go there (spoiler: people should want to go there). As data center demand in the Permian has continued to line-up, and egress from the basin grows, Waha prices (Permian gas prices) have tightened considerably, now priced just a few cents below with other Texas, and even Appalachian benchmarks trade at, though still cheaper than Henry Hub.

The charts above show the price of various non-Henry Hub trading points. The left chart shows the price of Permian gas (Waha, red line) compared to NYMEX/Henry Hub, where Waha prices are routinely below NYMEX, and frequently negative. The middle chart shows how in-basin prices for historically discounted supply-hubs have evolved YTD (moving slightly higher), but are still below NYMEX priced gas; and the right chart calculate the LCOE for CCGT power when generated in-basin, using forward strip pricing, the red bar shows the fuel cost advantage that proper siting can deliver.

So if you’re a hyperscaler building a gas power plant to take advantage of cheap gas from the Permian — the bad news is there’s another infrastructure developer that is building an LNG plant to take advantage of the same cheap gas. You’re just front running an ultimately, closed loop. It’s offensively easy to build new pipelines connecting the Permian to the Gulf Coast, so that’s all the industry has done. This has led to an over-reliance on the Permian to deliver gas to the coast for export and balance the market There’s no other play that can get gas to the Gulf Coast for export in size (at least at the cost people are expecting). The good(-ish) news, you’ll have to eventually fight over it, and since we don’t draw swords anymore, that simply means you two will need to duke it out in the ICE order book (at which point, the act of drawing swords may feel preferable, if not less damaging). In the end, the in-basin consumers will win (recall above, $7/MMBtu gas is still very competitive on a KWh basis) and the LNG exporters will see low export utilization, as $7/MMBtu Permian gas is ~$11/MMBtu landed in Asia (read: uncompetitive).

The quantum of natural gas demand has been fundamentally underestimated, and power demand is going to begin competing with LNG exports in a big way

It’s difficult for non-industry watchers to truly appreciate how impactful the incremental wedge of gas demand from the power generation sector is to US L48 balances over the next decade. In 2023-2024 the expectation was that the US would exit the 2020s with ~120-125 Bcf/d of natural gas demand – today the expectation is we exit the decade with ~140-145 Bcf/d of demand. That’s a massive shift, especially for a commodity that’s priced at the margin!

As of a year ago, nobody expected power demand to ramp like it currently is forecast to – and accommodating this level of incremental consumption from data centers isn’t as easy as just drilling a few more wells. It’s going to mean new pipelines, new gas processing plants, even new plays are going to be needed (like the emerging Western Haynesville, led by Comstock Resources, or the San Juan Basin in New Mexico). All this infrastructure costs money – new gas plants, pipelines, well pads, sand mines – the equipment to fully handle both LNG and AI simply isn’t there – to build it would cost ~$80-100 Bn (this may not be a lot in the context of Silicon Valley, but in the context of oil and gas, it is), and it’s very hard to see how the US’ supply side can accommodate both aggressive expansions.

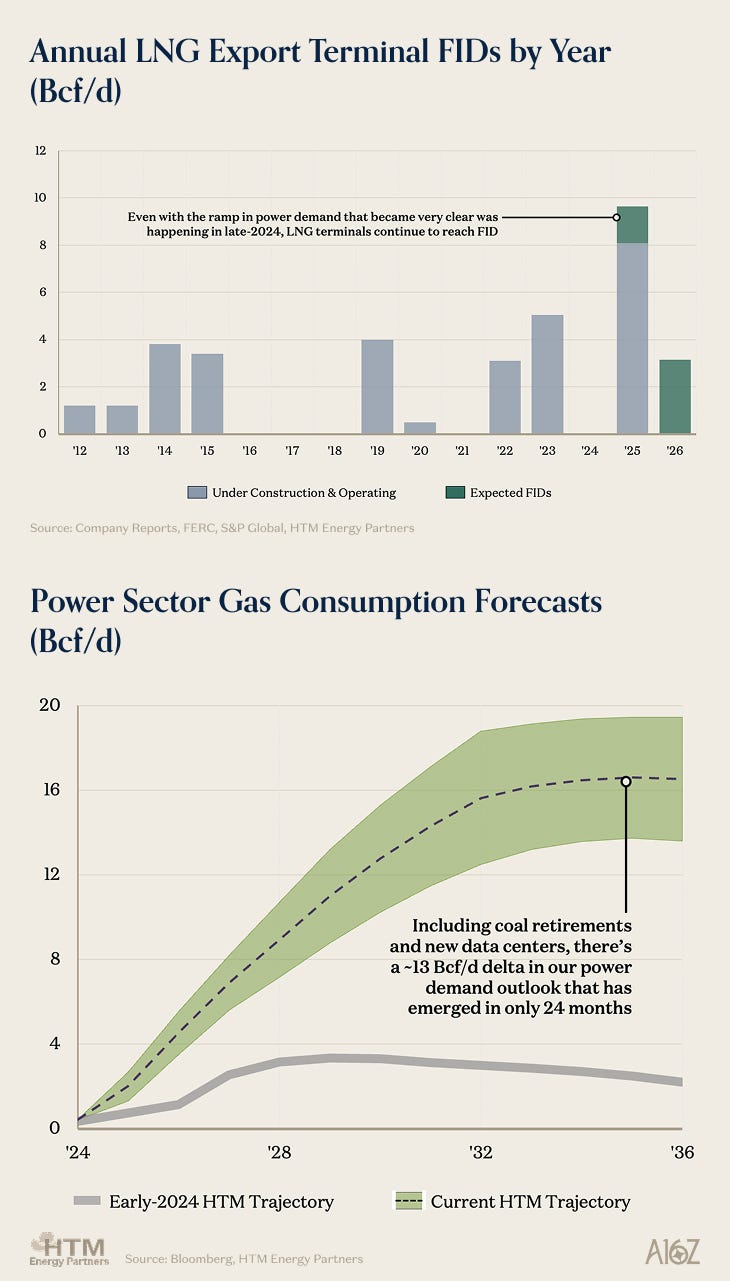

Since 2024 three things have majorly changed – the Trump administration reversed the previous ban on LNG export permits, then the power sector’s natural gas consumption has changed course in a significant way – with >10 Bcf/d of incremental demand over the next decade that has materialized in the last ~year; and finally, this administration has also removed a number of incentive programs implemented induce growth in renewables. All this has led to more gas demand than anyone expected going into 2025.

The charts above show the gas demand factors that have changed YTD, contributing to a drastic change in balance outlooks. The left chart shows a record number (and volume) of export FIDs YTD, while the right chart shows how power consumption forecasts have lifted.

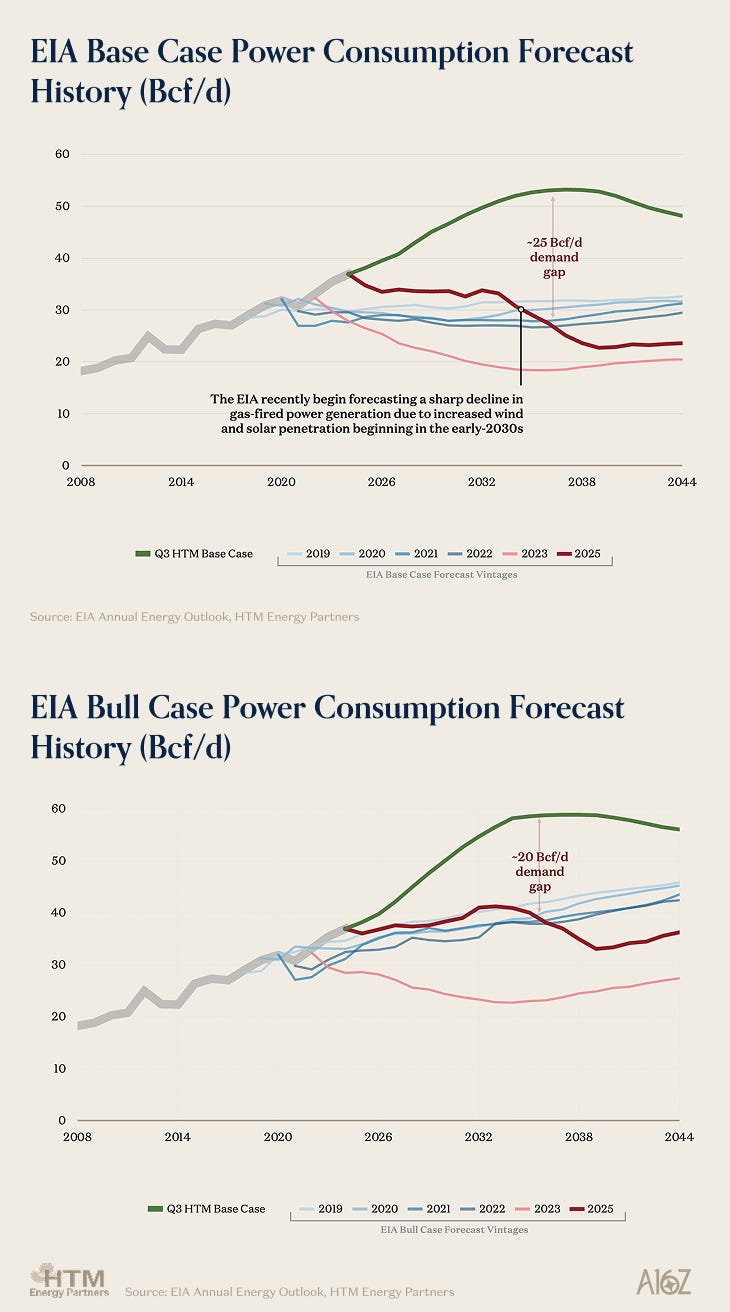

Take, for example, the forecast consumption of natural gas for power generation. As of April 2025, the EIA assumed that, in their upside case, demand for natural gas to generate electricity would grow ~10% through 2032, then begin declining. Their base case is even worse – with demand declining beginning in 2026. Anyone that uses the EIA domestic consumption forecast would be understating power demand. The current outlook for gas-fired power demand is a fully incremental ~10-12 Bcf/d for data centers and minor coal retirements, with no abrupt decline in the early-2030s. At the very least, it would be safe to assume that power consumption won’t be declining in the 2030s (which requires ~12 Bcf/d of production to stay online for 15 years – that’s 50 Tcf of gas, more than EQT has!)

Our base case for power below uses US-facing gas turbine delivery schedules reconstructed using company guidance. For example, just this year, EQT has entered into 1.4 Bcf/d of new supply agreements directly related to incremental data center projects.

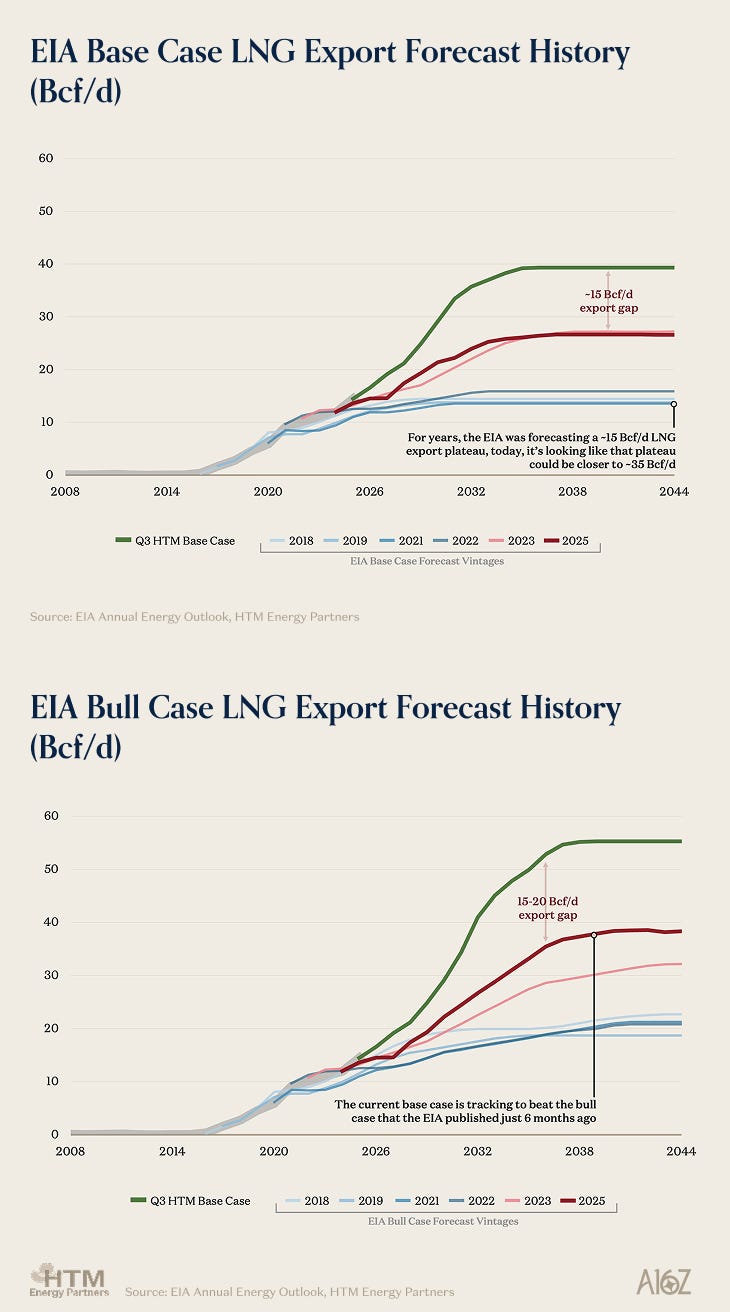

LNG exports see a very similar change in forecast trajectory – and you can’t even blame the EIA for this one! Since the agency published their 2025 Annual Energy Outlook in April, Cheniere, NextDecade, Sempra, Venture Global, and Woodside cumulatively reached FID on projects that represent nearly 7 Bcf/d of medium-term export capacity and nearly 11 Bcf/d of total approved export capacity. That’s up to 10% of current US supply FID’d in 9 months! Similarly, in the past year, a number of LNG export projects have joined the FERC filing queue (one 3.5 Bcf/d terminal joined just one week ago), moving the bull case fiercely higher.

Both this increase in peak, and the duration of demand are going to completely change the dynamics of the North American gas markets. US domestic gas balances were barely supplied through 2030 before any incremental data center power demand. Prior to data centers, the industry already needed to deliver ~25 Bcf/d of supply growth through the early-2030s, which was possible with all plays firing on all cylinders and a small wedge of new Canadian imports. That growth to respond to incremental LNG export capacity was using up almost all of the country’s reasonably economic drilling inventory. Now, we need to deliver ~40-45 Bcf/d of production growth! The incremental ~15 Bcf/d of growth is not easy. We might be able to accelerate activity that was already going to happen in response to LNG export capacity; but a true incremental ~15 Bcf/d of growth will not come cheap, will be difficult to maintain. At the price the last few wells need to come online, we’ll be in demand-destruction territory. The era of unlimited gas for all – is decisively over.

We continue to come back to the one (or, one of the many) core “busts” in how people are thinking about the gas market. Over the last 10 years, supply has induced demand. Over the next 10 years, demand will have to induce supply – but consumers think that clearing price will be the same as the supply-induces-demand price. There’s a difference between supply reacting and demand pulling – and one thing we’re confident in – there’s not going to be nearly enough “please come take it” supply going forward to fulfill the wishes of everyone waiting for their share of cheap gas to materialize. The fact that midstream developers have concentrated on Permian egress doesn’t help either. There is lots of natural gas Permian, and we underwrite almost 13 Bcf/d of Permian dry gas growth to answer in-basin demand and fill pipelines out of the basin – but the Permian’s gas supply is very binary. Permian gas is either free, or expensive. There’s no in-between. Associated gas is low-cost and price-insensitive, but dry gas from the Permian Basin isn’t zero cost as people are used to. Put another way – the cost to incentivize gas growth from the Permian, in excess of the current associated gas supply trajectory, is ~$3-5/MMBtu, not ~$0/MMBtu – and there’s far more demand than, associated gas growth in the Permian. As producers move into lower-quality rock, the real life vs. “spreadsheet breakeven” cost of adding supply begins to emerge. There’s lots of gas at $5-6/MMBtu, but there’s less gas when price might be $5, $3, $2, or $8. So expect more fixed price contracting – this can be a good thing for both sides of the industry (especially if approaching new compute campuses with a multi-decade vision), but it’s a more collaborative, than unbridled free market endeavour (to the net benefit of all).

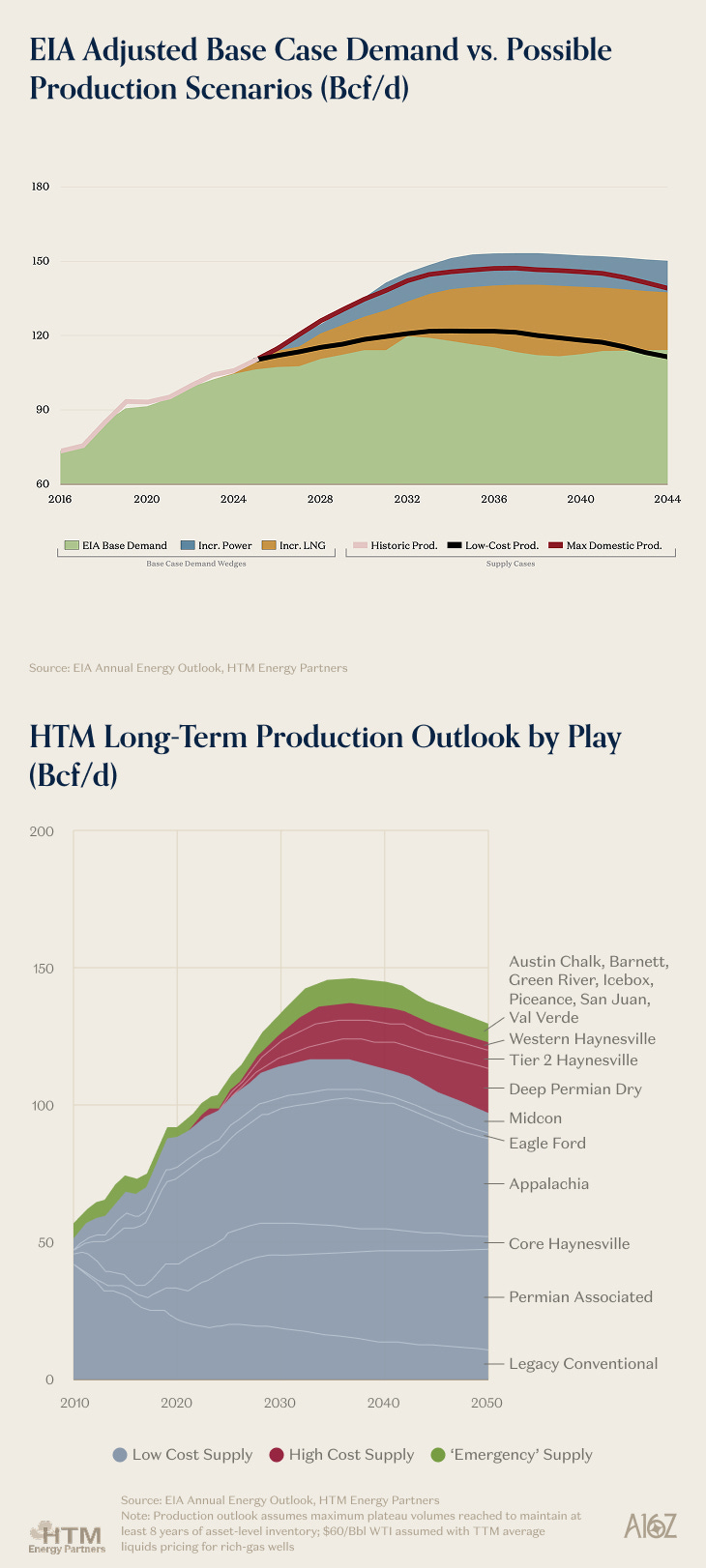

The left chart below takes the unadjusted EIA base outlook, and supplements it with our adjusted power, and LNG wedges (shown above). The right chart breaks out our bluesky-upside production trajectory by play. Going above 120 Bcf/d of production, the US is pushing the limits of its low cost resource, and above 135-140 Bcf/d, it’s higher prices or inventory-life-compression. For a country so blessed with the geology, technical expertise, and enterprising values that make the upstream industry so great – the customers that benefit from this should not let the market get to a point of near-implosion, it’s not a desirable outcome for anyone, but it’s looking more likely every day.

The charts above show what US supply is likely to look like in the future, along with the demand-stack. The left chart shows low-cost gas production in black, along with a theoretical high case, what would be possible if we push every basin to its limit. The right chart breaks out the plays driving the underlying growth; with the high cost plays in red, and the very fringe “emergency” plays in pink.

How do both sides of the industry evolve to make room for AI, without ruining LNG exporters

The natural gas story wouldn’t be a great American tale without easy access to cheap capital, exporting natural resources for fiscal dominance; and ultimately overcapitalizing a cyclical industry to the point that lifetime returns end up, completely avoidably, negative. The Great Wall of China took 2,000 years to build. The US’ upstream industry fully developed the Permian Basin inside of a decade – the industry is frighteningly good at producing hydrocarbons. Much like the US found a place for all its cheap gas while earning an economic return – the US’ highly cutthroat market will find a way to reorganize gas flows, and part of that is adding more gas resource. Canada (ew?) will eventually answer a large call on supply, which should help the US expand its low-cost supply curve (the first midstream company to seriously work on, and propose in earnest a large-diameter transmission line between Alberta and the USGC could earn an above-average return on a large sum of capital).

In the meantime, the US should focus on reining in LNG developers, not only for the good of their shareholders, but humanity in general. For the most part, LNG demand growth is coming from less-developed nations where infrastructure capital is scarce, and natural gas is fully incremental energy. It would be a net-positive for the world if the US avoids inducing gas infrastructure spending in less-developed nations, before ramping the price on that gas as AI demand lifts domestic pricing equilibriums (i.e. rugging developing countries). There’s room for the world’s gas demand to grow, but global welfare is lower in a situation where emerging economies become reliant on US gas, and end up competing directly with the US’ tech sector to serve their citizens a utility (they’ll both lose, and undermine the very principle of a utility). If we burn the gas domestically to progress a globally strategic industry, the US gets to internalize the economic benefit of cheap power, while global welfare is never lowered.

For data centers/hyperscalers that have decided they want to take a more cautious approach (or use someone else’s balance sheet) – they’ll eventually need to face reality and build their own infrastructure (the horror). Those that continue to trust merchant markets like ERCOT will always shoulder a huge principal agent problem. Generators will always be trying to maximize their profits (high pricing upside), while AI data centers at some point in the future will begin working on lowering their cost of serving inference, rather than the brute-force race to energize capacity we’re seeing today. At one point, this has to resolve in hyperscalers becoming more-integrated, building their own micro-grids that prioritize their own reliability and cost objectives. The sooner we can commit to a more-firm gas consumption trajectory (i.e. the sooner Silicon Valley can care about gas for the first time!) the sooner the upstream industry can prepare a supply response, the LNG industry can adjust their infrastructure plans; and the better off the world is. Countries like Pakistan are already cancelling LNG cargoes, and massively expanding solar generation. Most of this solar proliferation is led by China; and most of the proliferation is in countries that US LNG exporters one-day planned on selling gas to. Let them embrace solar, we will eventually too! Less-developed nations are in a place where one unit of incremental energy, no matter the time of day, is a net-positive.

While “figure out AI already” is a tall ask in an industry so nascent; it’s less about hard-numbers, and more a buy-in that has to come from, well, the biggest decision makers in the world. It’s a buy in from the mega cap tech leaders and the US administration (maybe Canada too), to directionally appreciate where AI is heading, match bottoms-up baseload demand with baseload generation, realize the world is net-better-off burning our gas at home, and strive to accomplish a generational proliferation of gas-fired-intelligence.

Thanks for reading this far! For anyone that wants to chat about natural gas, sector opportunities, or data centers in general – feel free to drop me a line at michael@htmog.com.

This newsletter is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. Furthermore, this content is not investment advice, nor is it intended for use by any investors or prospective investors in any a16z funds. This newsletter may link to other websites or contain other information obtained from third-party sources - a16z has not independently verified nor makes any representations about the current or enduring accuracy of such information. If this content includes third-party advertisements, a16z has not reviewed such advertisements and does not endorse any advertising content or related companies contained therein. Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z; visit https://a16z.com/investment-list/ for a full list of investments. Other important information can be found at a16z.com/disclosures. You’re receiving this newsletter since you opted in earlier; if you would like to opt out of future newsletters you may unsubscribe immediately.