Charts of the Week: Customer Service Reckoning

Industrials valuation pop; SF is the hub; Capex; White collar sitters

| Nation | Tech | Opinion | Culture | Charts |

Customer Service Reckoning

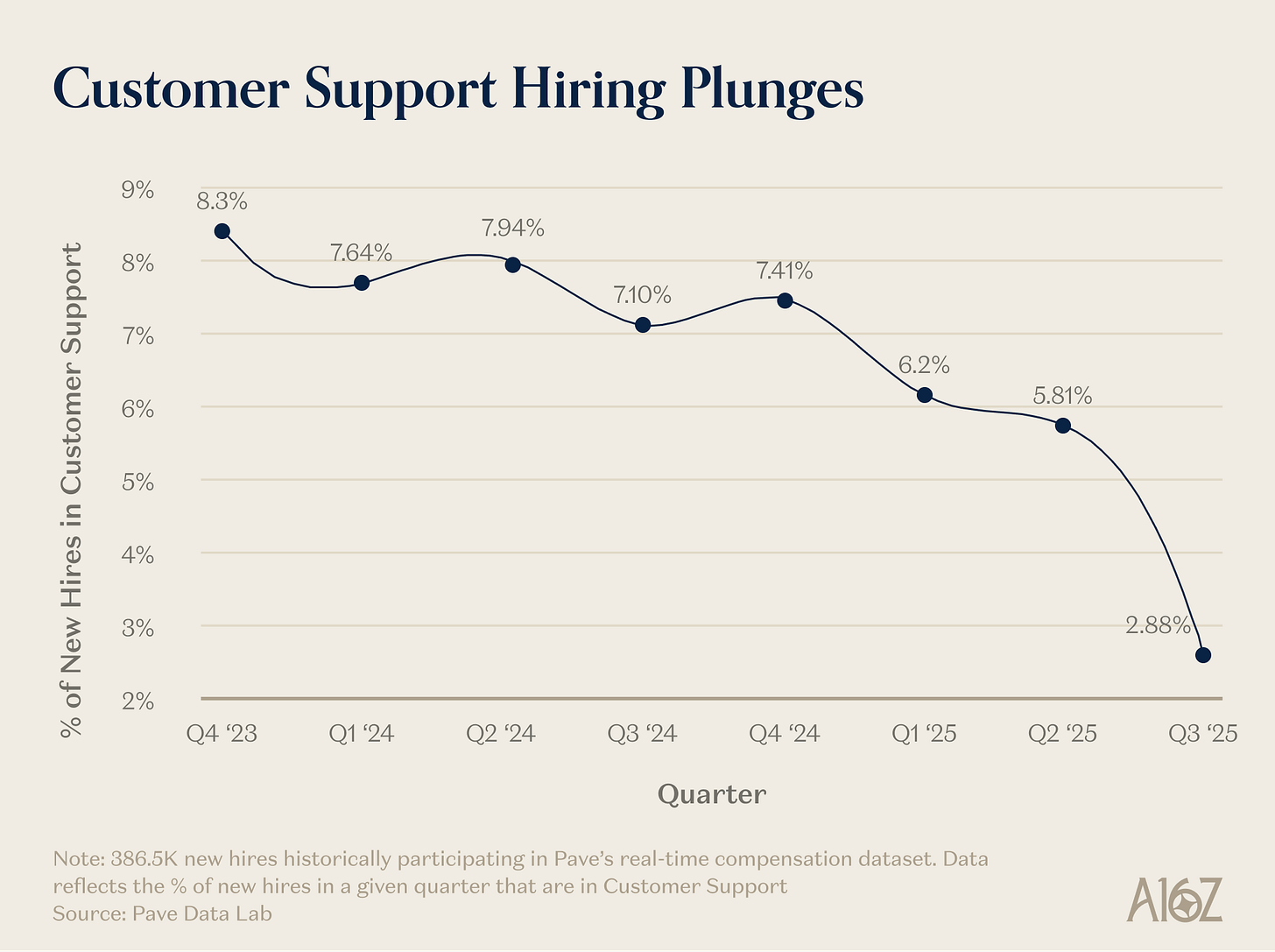

Some roles are surely feeling competition from AI:

The percent of new hires heading to Customer Support is about a third of what it was ~2 years ago, dropping from 8.3% all the way down to 2.9% in Q3 ‘25.

The most precipitous drop, however, was in the most recent count (between Q2 and Q3).

This is just one survey, so take it for what it’s worth, but the fact that customer support roles are vulnerable to AI substitutes should come as no surprise. Offshore call centers were hammered in the public markets, well before SaaS became the center of attention.

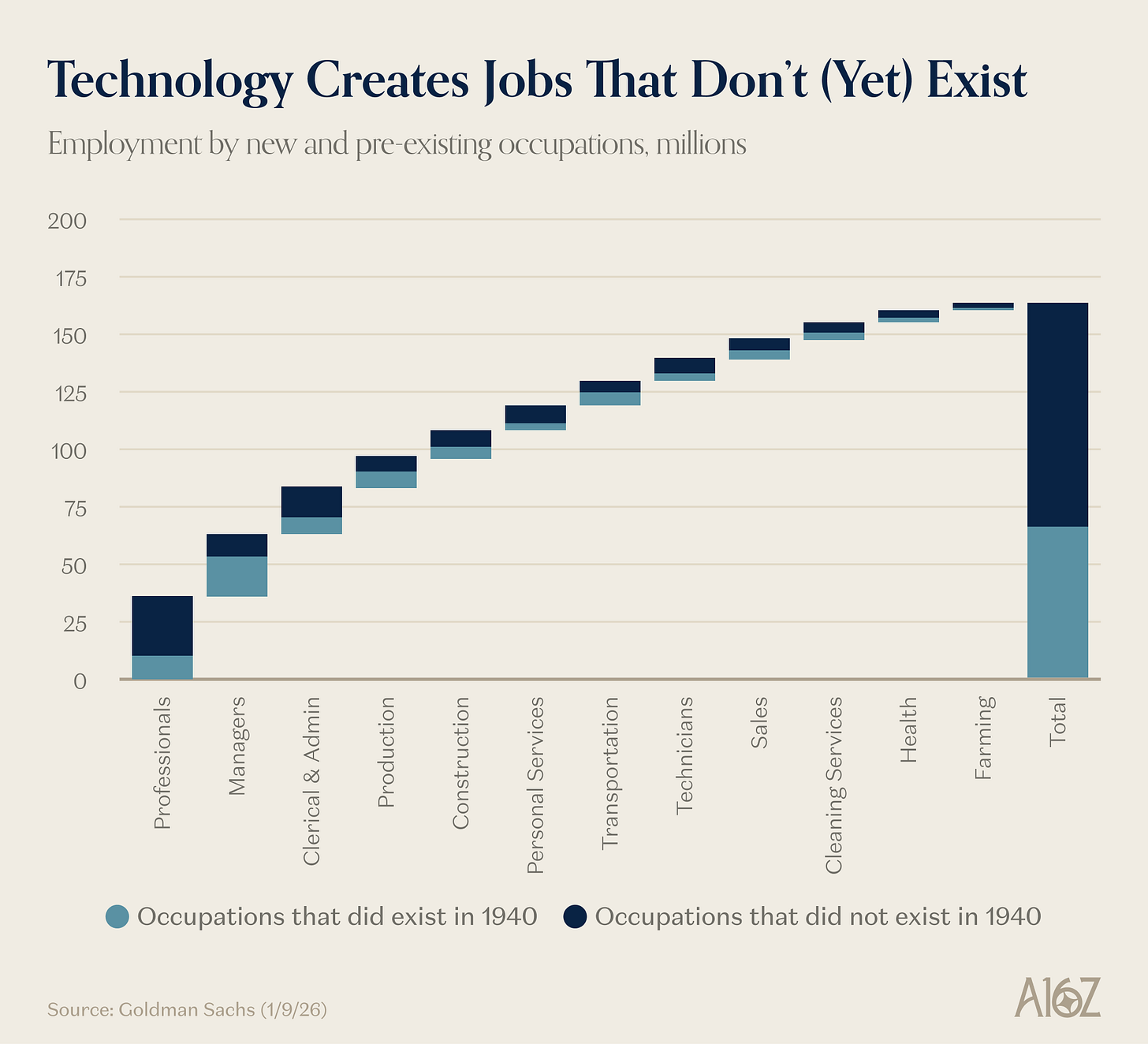

That said, just because AI is replacing some functions, doesn’t necessarily mean that AI is going to be a job-killer. AI has actually put a premium on certain roles, recently, and if history is any guide, AI (like the new technologies before it) is going to create new jobs.

What jobs? Well, we don’t know yet, because in all likelihood, AI will create new types of jobs that don’t currently exist:

Over half of net-new jobs since 1940 are in occupations that did not even exist in 1940.

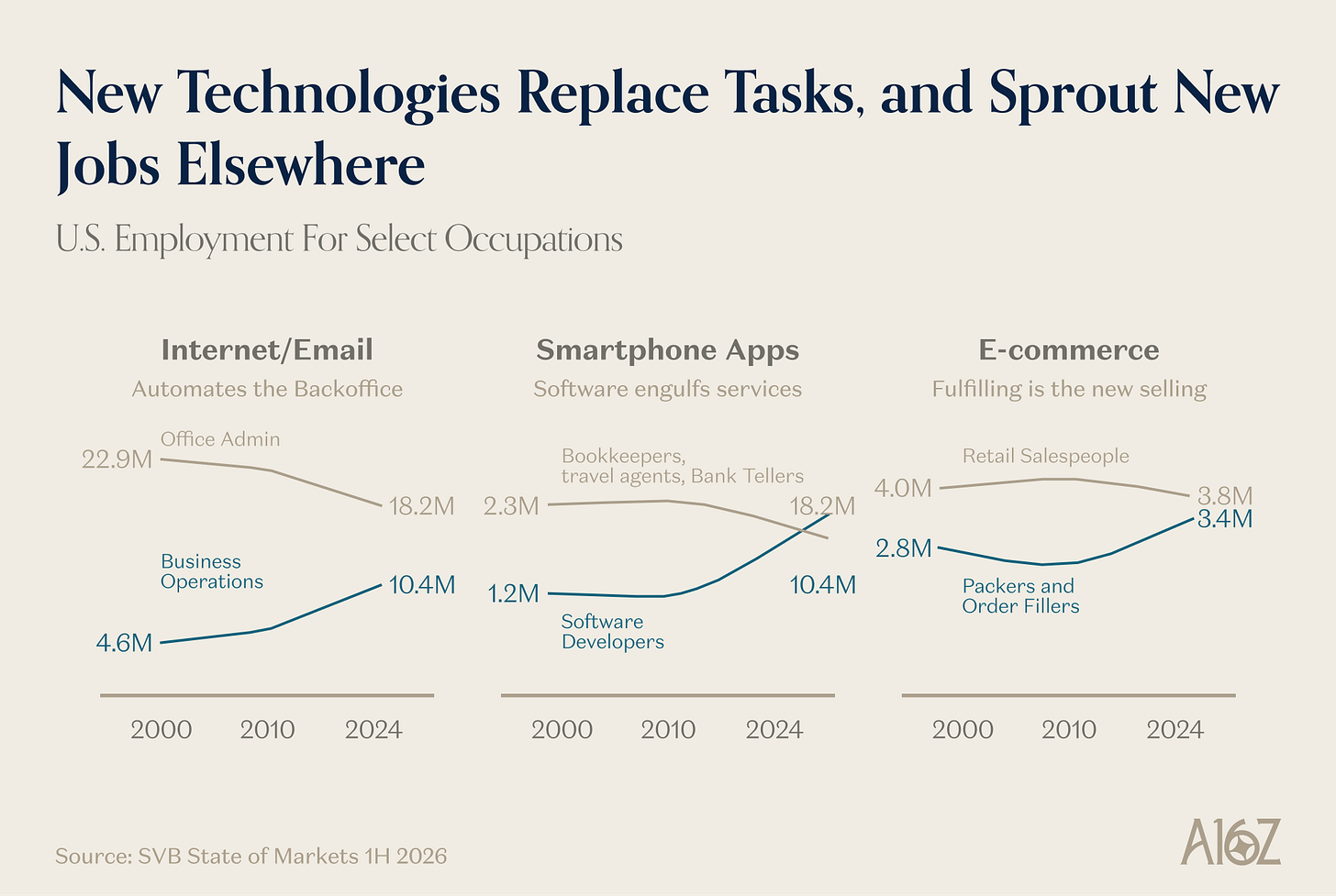

Likewise, after the previous platform shifts, while certain occupations shrunk, others rose (and more than offset the loss):

Fewer admins, but more biz-ops

Fewer customer-facing service roles, but more software developers

Fewer retail sales people, but more warehouse fulfillment

As Marc Andreessen recently observed, “a job is a bundle of tasks.” The task-bundles will surely change, but there will always be jobs to do.

Industrials to the moon

The recent selloff to SaaS has been less of a market wide sell-off, and more of a market rotation, from parts of tech to elsewhere. And all that rotation has led to some changing of the guard in the broader valuation multiple hierarchy.

For example, Industrials are now higher priced than Tech:

Forward P/E for Industrials nosed slightly ahead of IT, and is now at the outer range of its 20 year benchmark.

It’s unclear which is a stranger thing to behold: that the market is now pricing Industrials higher than Tech, or that Industrials are now priced ~8 turns higher than their 20 year median.

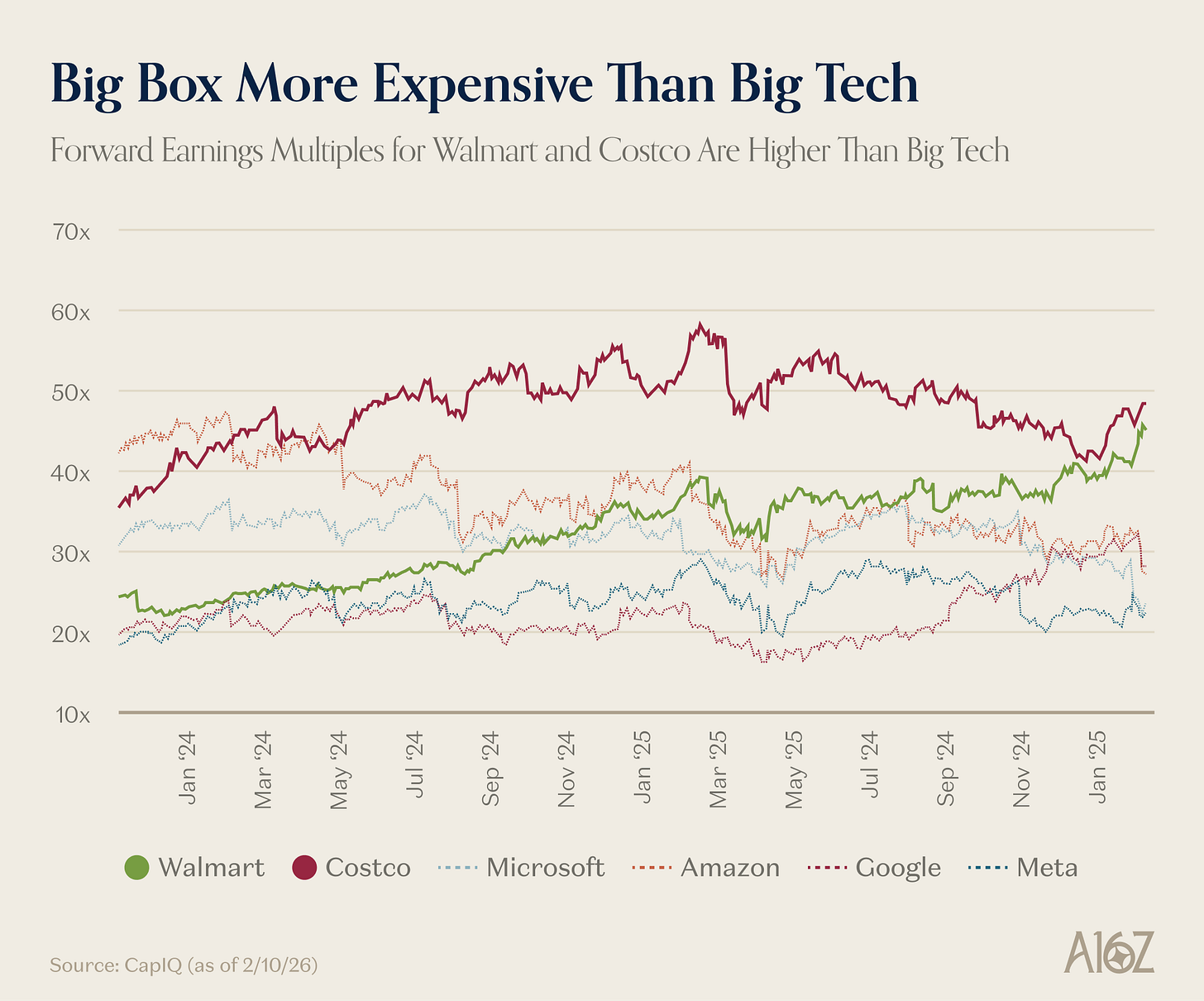

Here’s another fun one.

The big retailers, Costco and Walmart have higher earnings multiples than any of Google, Amazon, Microsoft and Meta:

Shopping centers are commanding near 50x multiples, while some of the biggest techcos are languishing between 20x-30x.

Tech gets no love, while industrials, retail and value are enjoying fun in the sun.

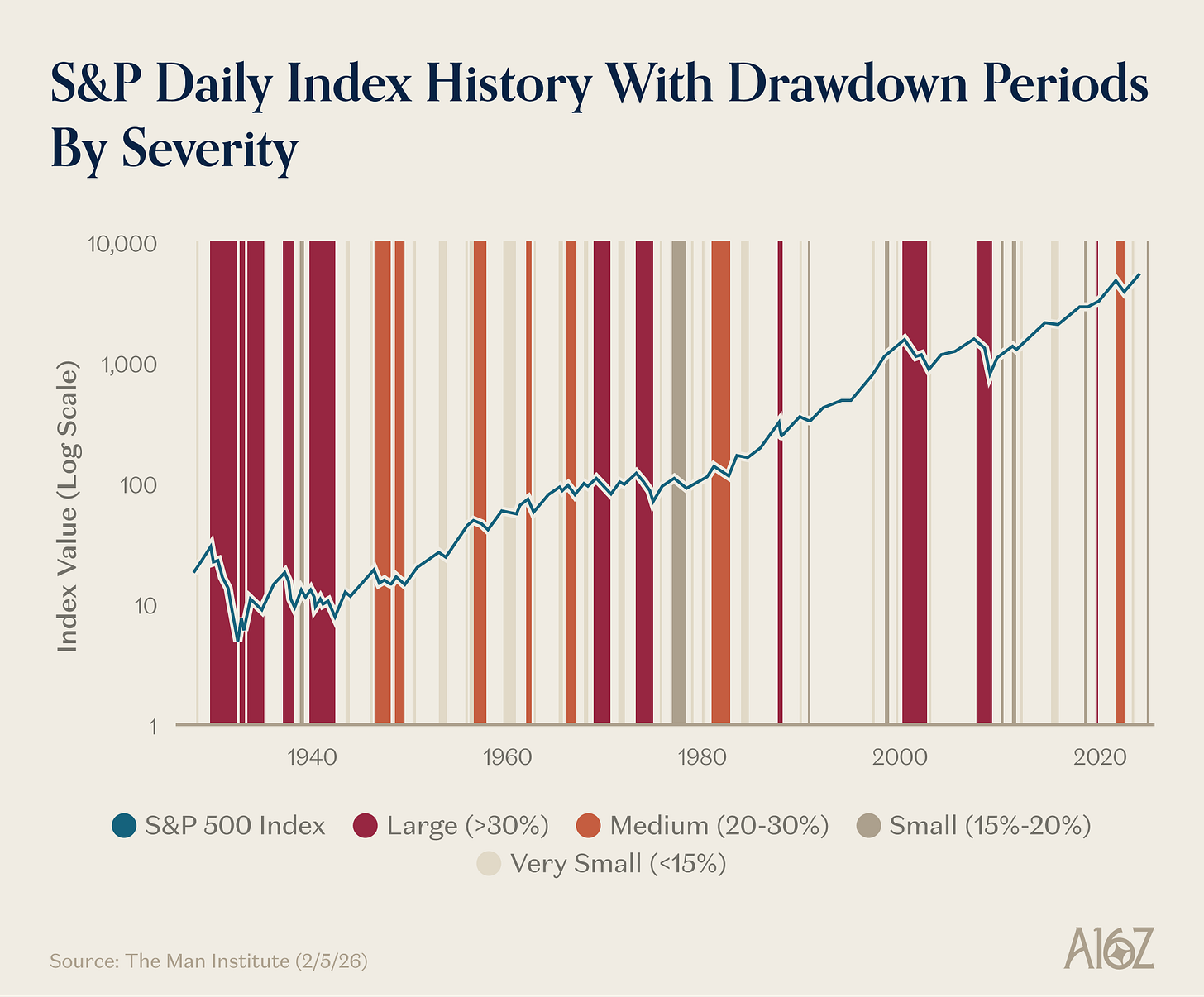

Mr. Market moves in mysterious ways, but in general, full market drawdowns have become fewer and far-between:

Market-wide drawdowns of any severity have become less frequent since the 80’s.

Make of that what you will, and of course, past-performance does not guarantee future results, but while rotations can be painful, they’re surely better than a big selloff.

SF is the hub

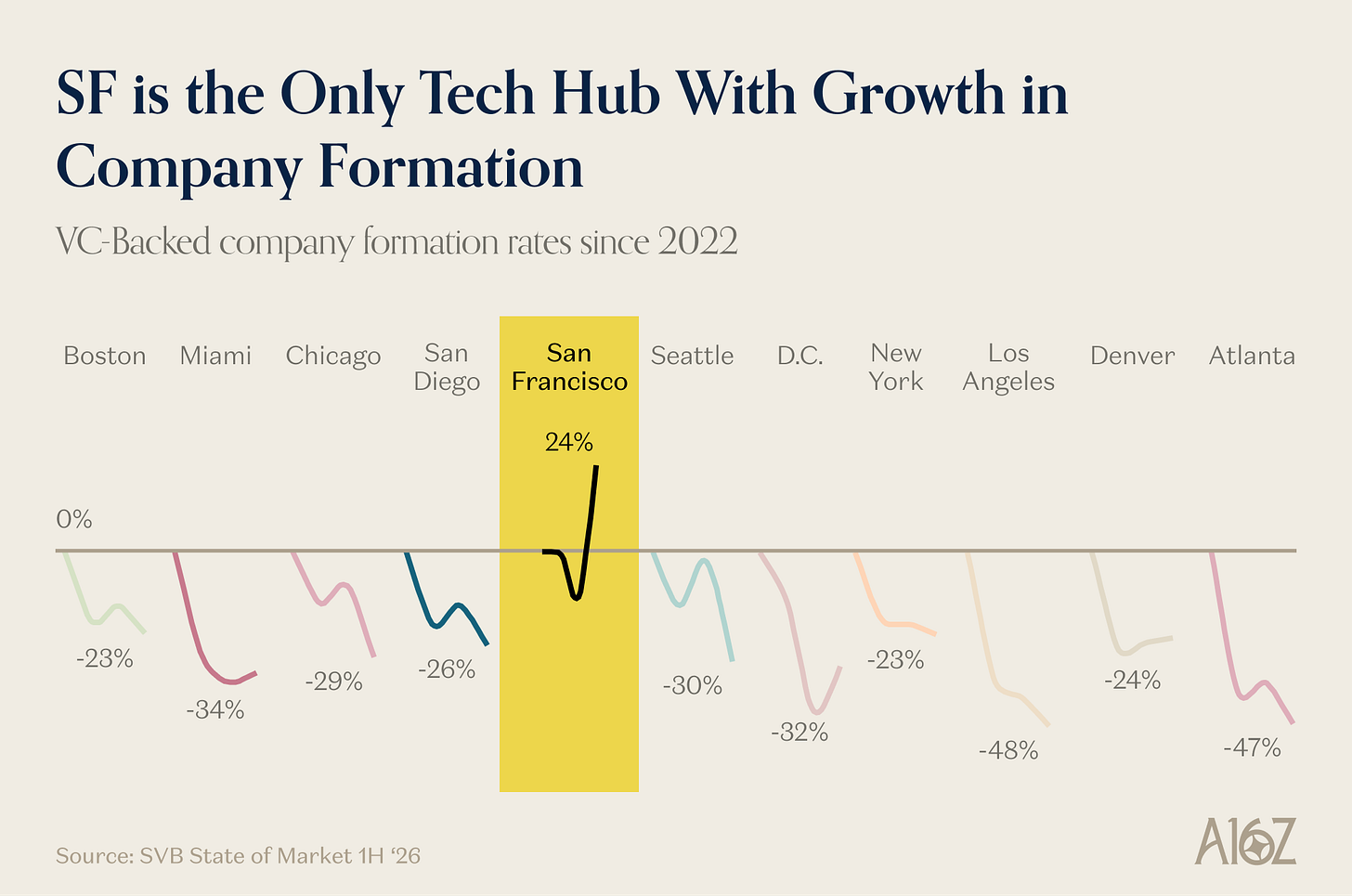

SF (and only SF?) appears to be back:

SF is the only VC-hub to experience an increase in VC-backed company formation (since the high watermark of 2022). Company formation growth has been accompanied by a resurgence in demand for SF office space, as well.

Why is company formation booming? Follow the money, of course.

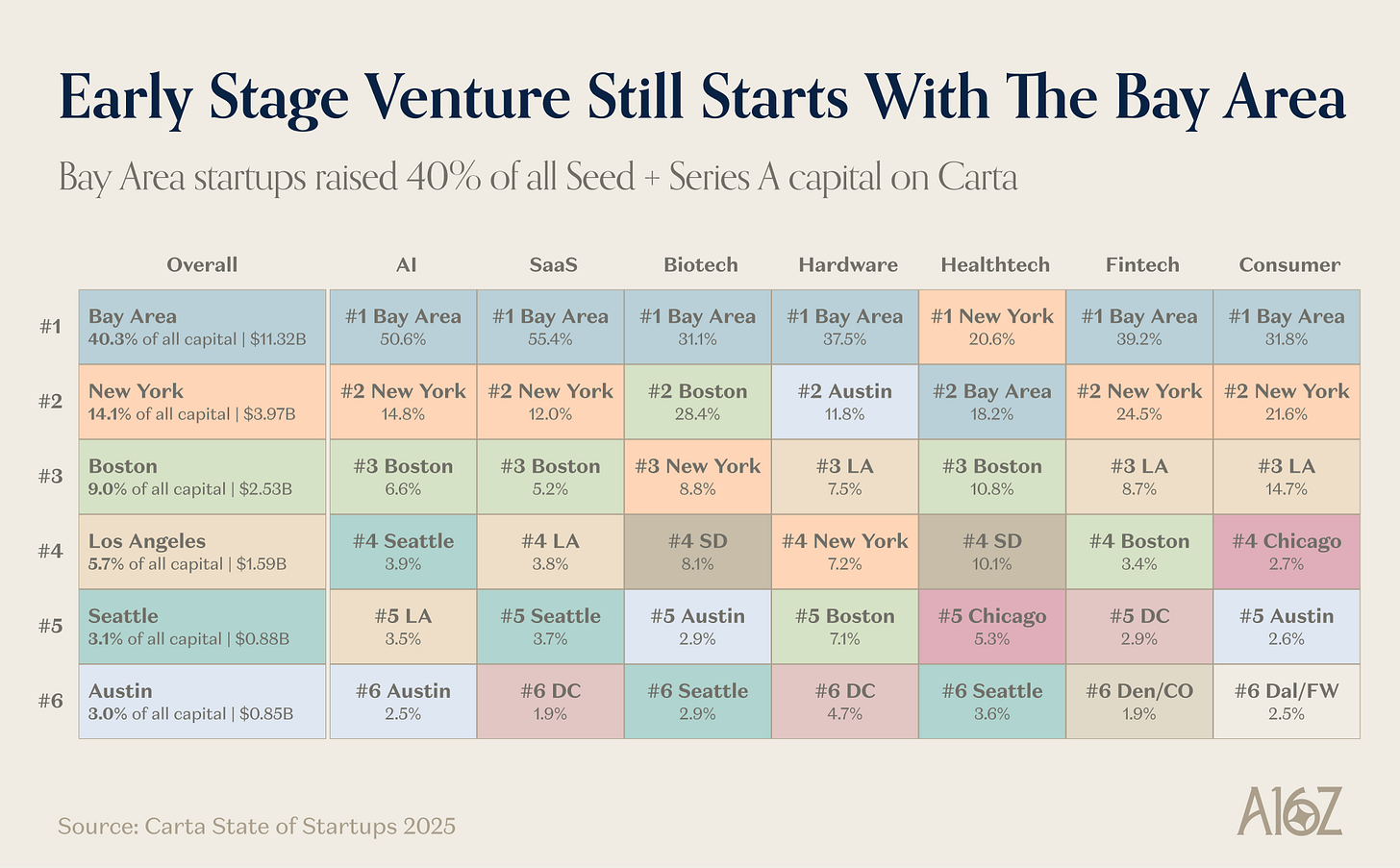

According to data from Carta, the Bay Area has captured ~40% of all early stage venture dollars (from Q3 ‘24-Q2 ‘25), and is the #1 market for venture dollars in every vertical but Healthtech (where it’s second to NY).

It’s no secret that Venture has contracted from the heady days of ‘21-’22, when new hubs were emerging e.g. in Miami and Austin.

In the more recent cycle, though, it’s pretty clear that SF is where the lion’s share of the action lives, for better or for worse.

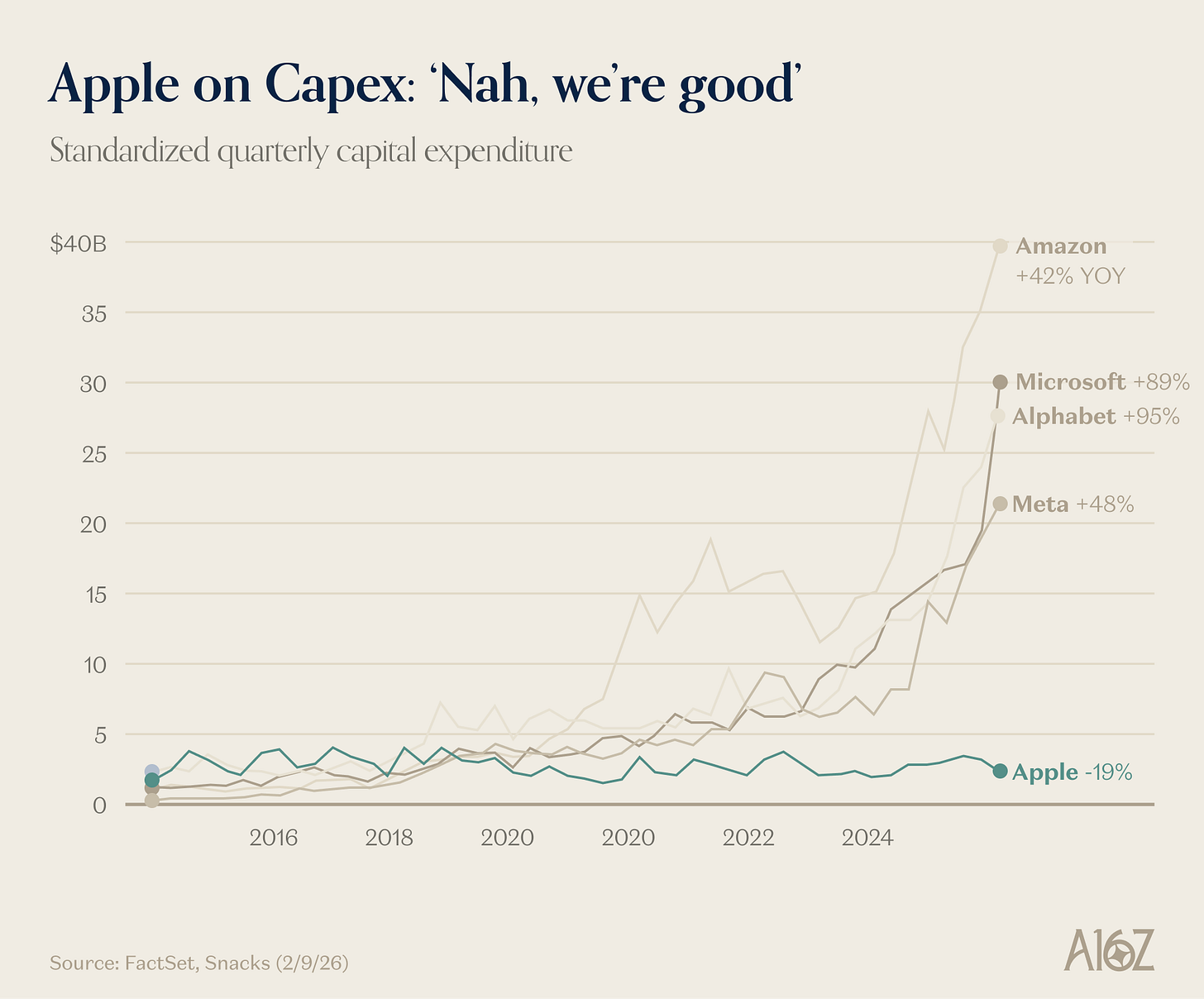

Capex for most (but not for everyone)

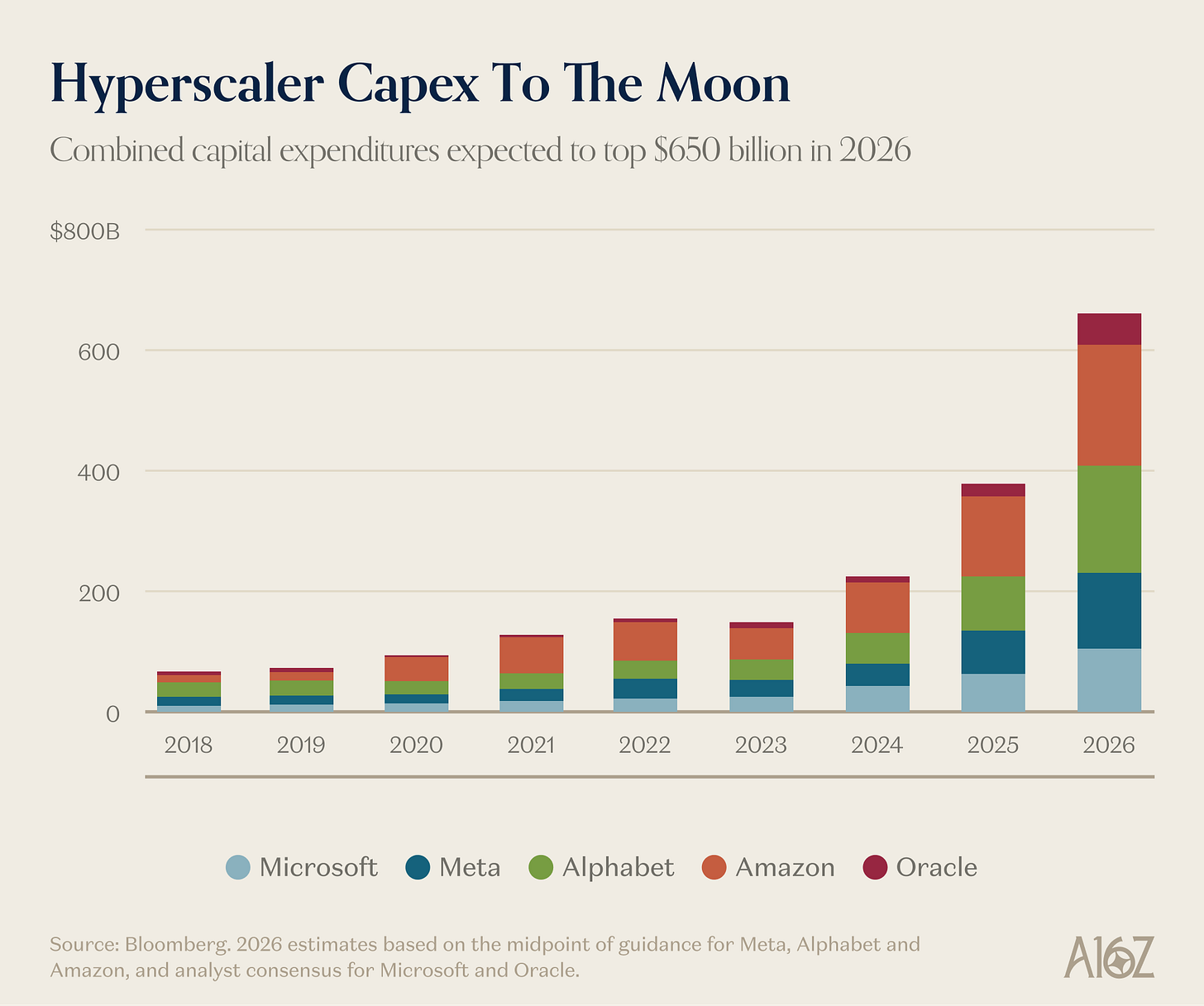

Hyperscaler investment in the AI buildout continues to grow:

Estimates for 2026 Capex at the Big 5 have risen to $650B.

$650B in chips and data centers is a lot of chips and data centers (and doesn’t even include all the spending to be financed with debt). It’s also ~3x more spending than just 2 years ago, way back in 2024.

Anyways, we all know the story. For the Big Tech Cos, demand for compute continues to build in excess of supply, and at least some of them are on record as saying AI is a race that they cannot afford to lose.

Not all Big Tech feels the same way, however:

While Meta, Amazon, Microsoft and Google watch their Capex soar, only Apple reduced its Capex last quarter.

Apple is sitting this one out, apparently.

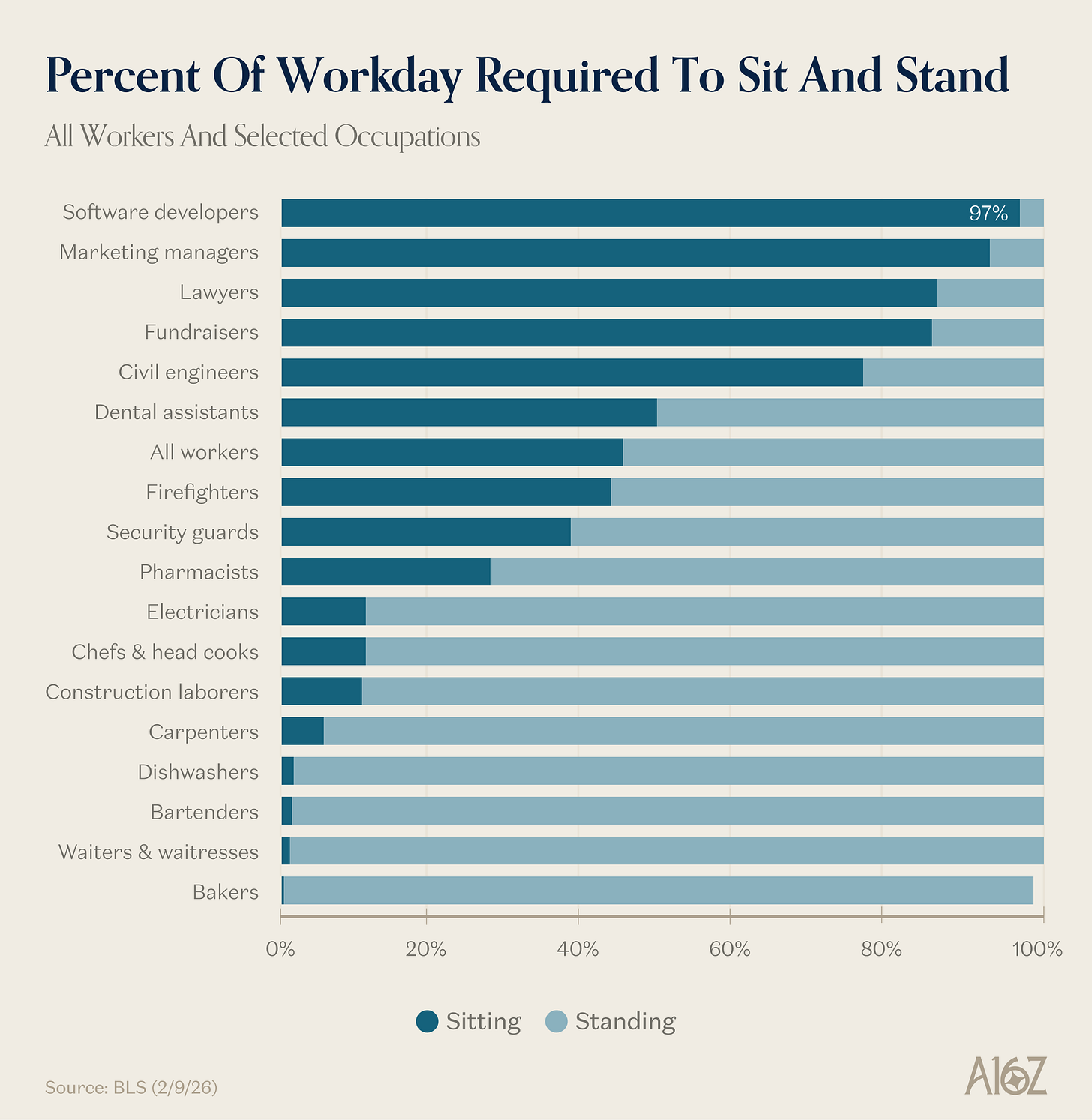

White collar sitters

And finally, while on the subject of “sitting,” some people sit more than others.

According to a recent survey from the BLS, some people sit a lot more:

Software developers report sitting a staggering 97% of their workdays, with Marketing Managers being the only other category north of 90%.

At the other end of the spectrum, bakers, waitstaff, bartenders, and kitchen staff are on their feet the most, reportedly sitting less than 2% of the time.

There isn’t a whole lot of commentary to add here. Sitting is bad for you, people. It’s time for some standing desks, for real this time.

This newsletter is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. Furthermore, this content is not investment advice, nor is it intended for use by any investors or prospective investors in any a16z funds. This newsletter may link to other websites or contain other information obtained from third-party sources - a16z has not independently verified nor makes any representations about the current or enduring accuracy of such information. If this content includes third-party advertisements, a16z has not reviewed such advertisements and does not endorse any advertising content or related companies contained therein. Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z; visit https://a16z.com/investment-list/ for a full list of investments. Other important information can be found at a16z.com/disclosures. You’re receiving this newsletter since you opted in earlier; if you would like to opt out of future newsletters you may unsubscribe immediately.

The only thing we don't know yet is whether the decisions to reduce Customer Support is actually driven by the business that runs the CS or the customers who actually want it.

In other words, soon, we'll know if the world and customers will actually want automated solutions via bots, AI, etc. and whether many companies will have to pivot and revert back b/c "Proof of Humanity" is actually a thing.

Silicon Valley is the king of over-correction.