What is New Media?

We get asked a lot! So here's our mission:

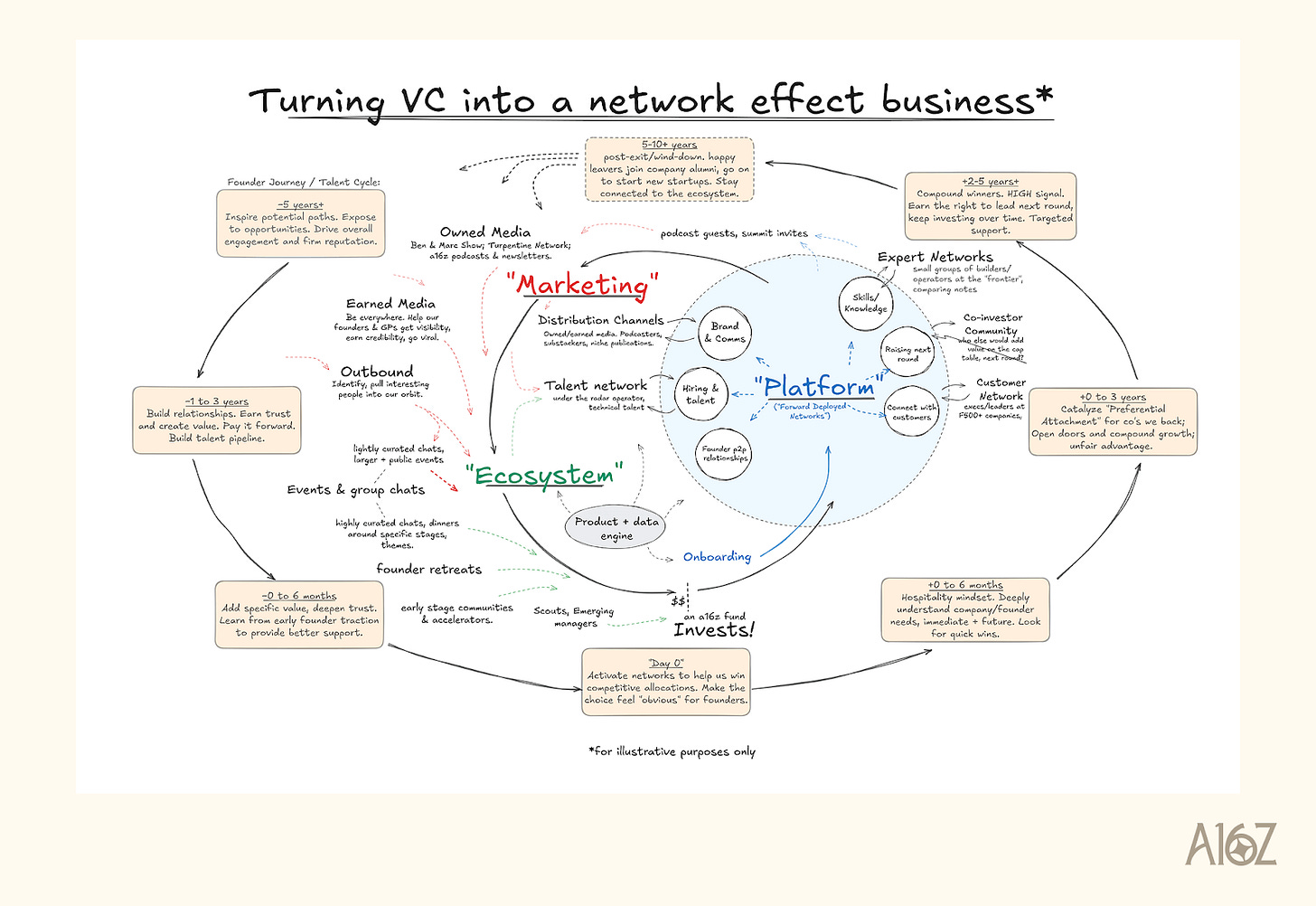

An important part of a16z’s origin story, which you may already know, is that we were founded by Marc & Ben to be “CAA for the tech industry.” When Michael Ovitz founded CAA (The Creative Artists Agency) in 1975, Hollywood was completely controlled by a few dozen big entities, who served as gatekeepers to the entertainment industry. Ovitz built CAA to help the creative actors and artists build franchises on their own terms and forever changed how entertainment worked.

A half century later, a similar transition is happening in tech - or at least, has half-happened. The old guard of legacy capital, legacy media, and legacy distribution can now be sidestepped; anyone can go viral, and gain relevance for a day. But what do you do with this? As a founder, what would you want from your VC - whose purpose is to give you power and legitimacy - to navigate media today?

That’s why we built the a16z New Media team.

Our goal is to build the best turnkey media operation in venture: a single place where founders acquire the legitimacy, taste, brandbuilding, expertise, and momentum they need to win the narrative battle online. The team is a few months old, and we’re the only VC firm on the TBPN New Media Map (in fact, we’re on it twice). And we consist of:

An in-house team at a16z, made of online legends

“Forward deployed New Media”, embedded with portfolio companies

An ecosystem of “next up” high signal talent, ready to attach to great up-and-coming stories

And starting in January 2026:

The a16z New Media fellowship: an 8-week program for operators, creators and storytellers. Learn more and apply here:

The end goal of Venture doesn’t change: to help founders build generational businesses. But founders are asking more from their investors, and we’re eager to compete on this new playing field: delivering immediate, tangible wins for founders when they launch and grow their brands.

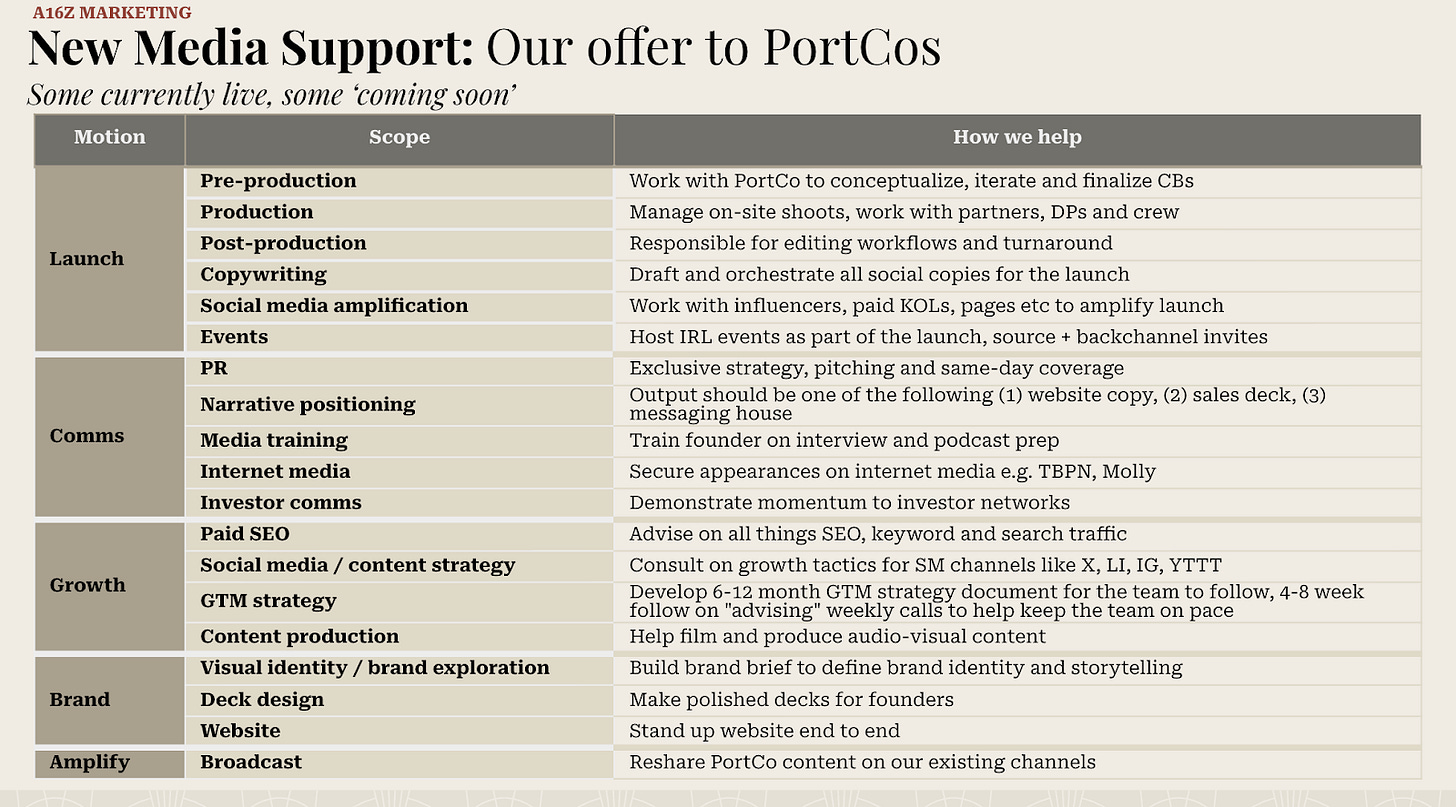

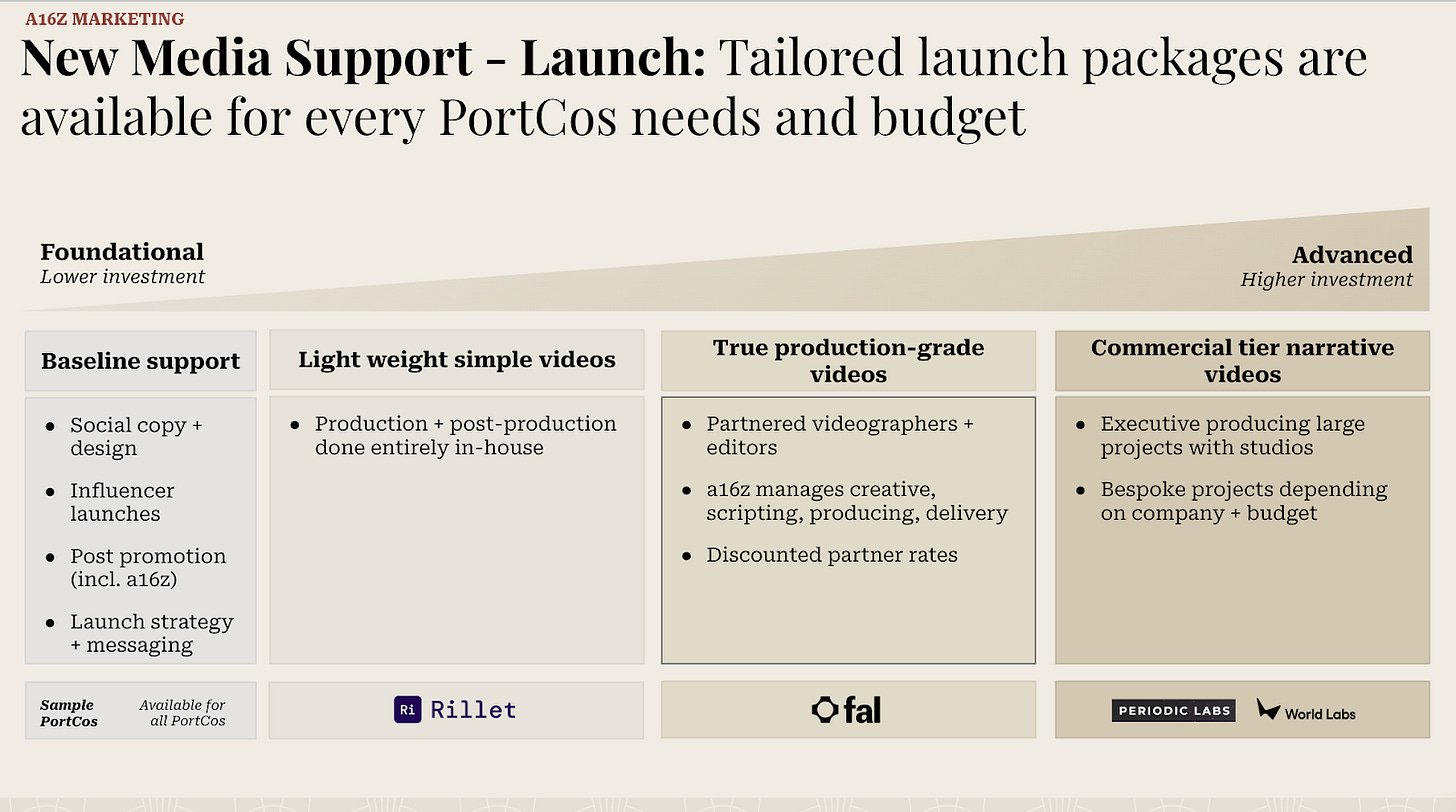

Here are three core parts of our “menu of options”, which at this time we offer to particular companies where we think we can move the needle:

The essentials. We build & run owned channels that are habit-forming and great brands; we build in-house creative muscle, and we make it all available for portfolio companies.

Timeline takeover. We offer “win the internet for a day” as a service, in any combination of particulars you want: a great video, an insightful podcast, essays, tweets, everything. A successful launch day is a critical opportunity to recruit top talent and find marquee customers: we give founders day-of help, and help build their own New Media foundations, including hiring their team.

High-signal talent ecosystem. We host the events, the group chats, and the high-trust environments where talented people decide on their next challenge. We make sure the a16z ecosystem is the obvious place to make your next move, and we make sure our founders get maximum advantage from having that ecosystem in their back yard.

Here’s how we do these things in some more detail; including selected slides from a presentation Erik gave to the a16z GPs a few months ago.

Own your distribution; or better yet, use ours

Once upon a time, “Own your distribution” was a radical idea in media. But now it’s just table stakes. You need a big audience, who hears from you a lot, and likes to hear from you a lot, because you deliver on your brand promise consistently. Andreessen Horowitz has a history of great owned content (e.g. the original a16z podcast, built by our good friend Sonal), and we want to build on that heritage, for this new moment in tech media.

As anyone who’s ever worked in media knows, you can’t just wave a magic wand and grow a high-quality audience. It takes craft, skill, and day-to-day persistence, to drive impressions up and to the right week after week. “It takes a lot of work to make it look easy”, as the saying goes. You’re fortunate and rare if you can find a partner who already has an audience and distribution, and whose incentives are completely aligned with yours, to help establish your distribution. But that’s exactly the relationship between us and our portfolio companies. We have every incentive to help launch you as enthusiastically as possible, and get you flying.

The craft of storytelling

Launching a product or a brand requires a tremendous amount of attention to detail. Yes, you can go viral and get lucky; but preparation is a big part of luck. We offer an extensive menu of services for our portfolio companies, up and down the New Media stack, that add up to one experience: “shipping a great story”. We’ve been there before; we know what it takes.

Style and joy

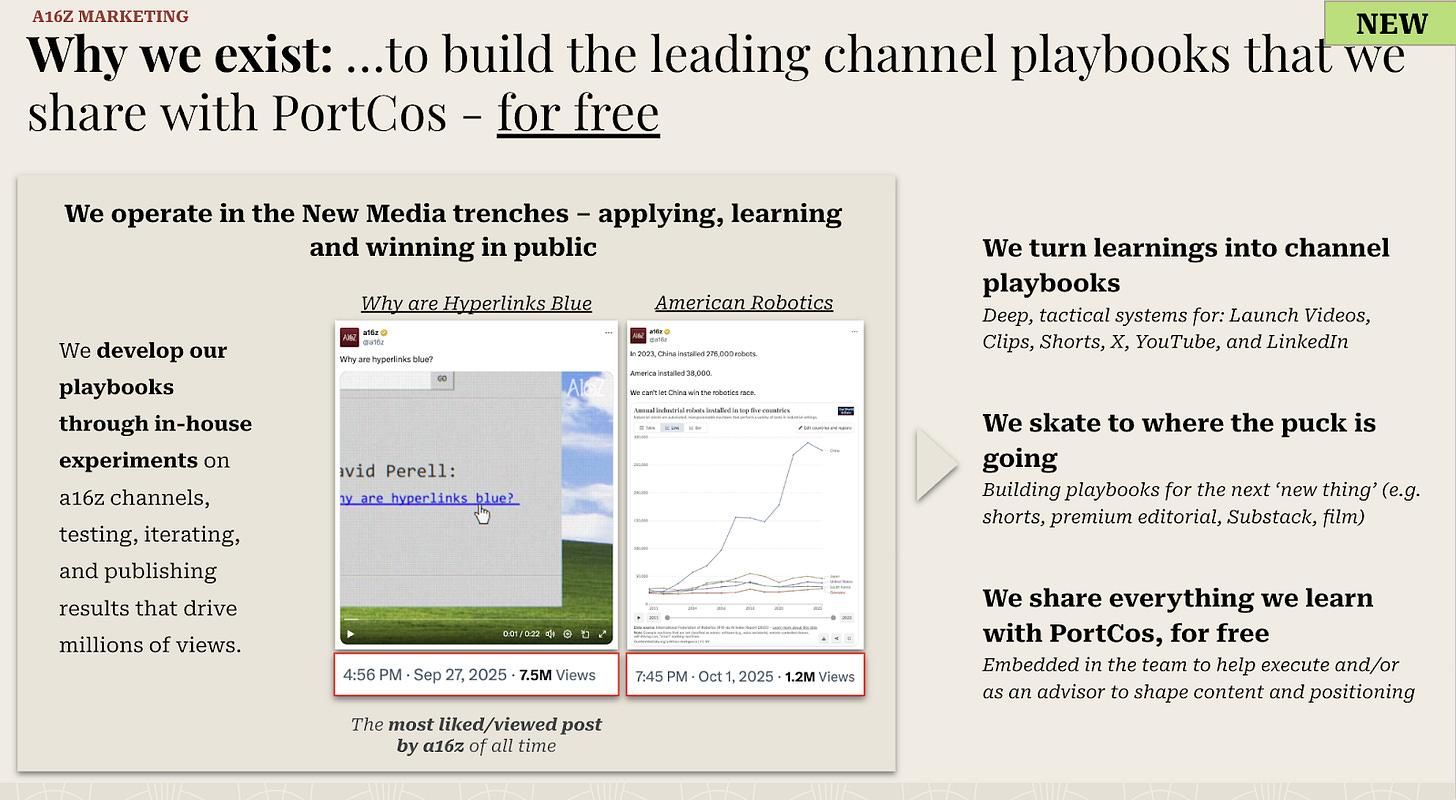

Great online content is half skill, half serendipity. For example, this short video of Marc Andreessen talking to David Perell about “Why hyperlinks are blue” was a delightful little joy on the timeline, because of the work that went into it: shortening it, animating it, making it delightful in little ways. Someone actually took the time to break down why this video performed so well, which we loved and appreciated. Seeing that kind of “if you know, you know” audience meta-commentary is a great reward for our work, and if you’re seeing a lot of it, something is going well. (Chartposting is another great example where a lot of work goes into the little details, like developing a house style.)

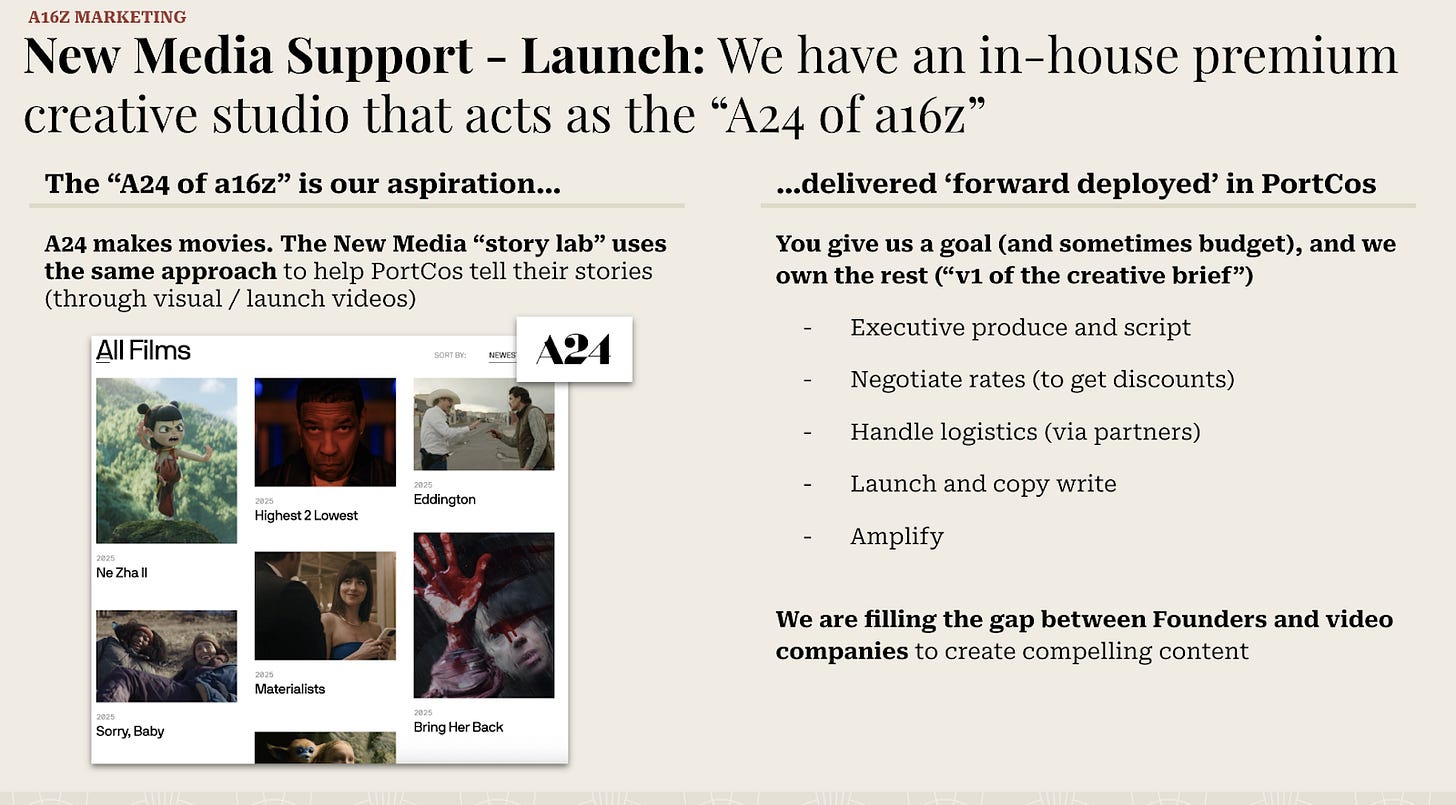

The a24 of a16z

Video is more than just podcast production: it can also mean first-party production, like for events such as Runtime. We have a team in-house, trained on set and inspired by New Media legends like Mr. Beast, and who can turn around beautiful videos out of a skunkworks operation. This means we aren’t beholden to outside contractors for turnaround time, style and taste, or anything else. And we accrue the learning benefit and production know-how it takes to scale up high-quality production to meet the whole portfolio’s cadence. (As Elon put it: anyone can make one Roadster; it’s really hard to make a million Model 3s, profitably. You have to do it in-house!)

Be habit-forming.

Owning a habit among your consumer or your customer is one of the most valuable things you can get in the world of New Media. Ben Thompson is successful not just because Stratechery is a brand, but also because Stratechery is a habit. That’s where we’re aiming with our owned media channels: why we’ve amped up our podcast to ship 5x a week, our newsletter to ship 5x a week, while raising the quality bar.

The other reason we ship daily is because that’s how you get in reps. If you ship something every week and get 1% better each time you ship on average, by the end of the year you’ll be around 65% better than you started. But if you ship every day, even if you only get .02% better (one fifth the benefit, but x5 the days), by the end of the year you’re 165% better. That’s why it’s so important to get in daily reps: because our portfolio companies directly benefit from that compound learning.

Timeline takeover: where it all comes together

If the goal of a VC firm is to get you power and legitimacy, then what does the New Media team do? Well, it should be able to help you dominate the timeline, on demand. This is an obvious goal to offer, but a very hard thing to actually be able to execute.

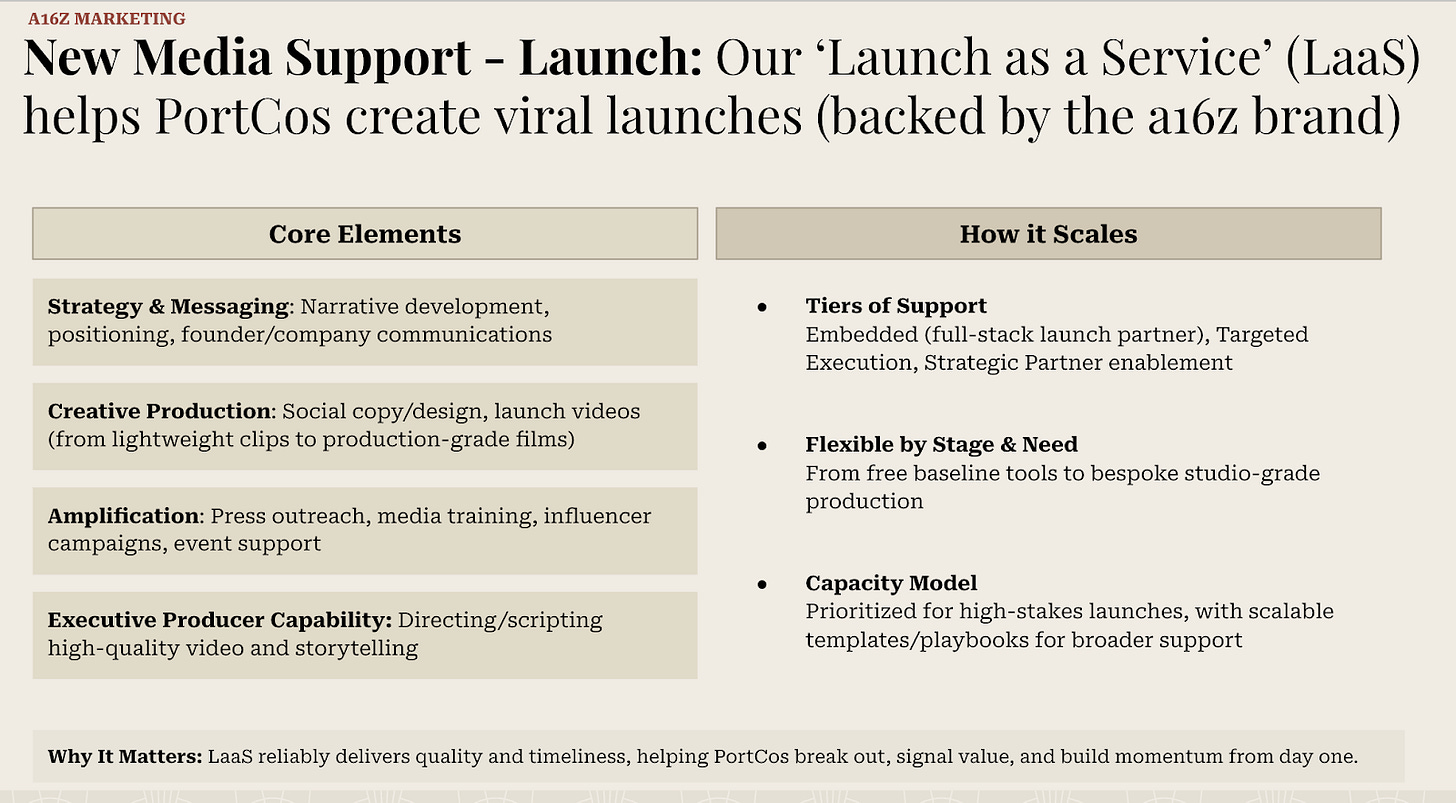

“Launches as a service” is designed to catapult your brand forward, with our brand. And a lot of ingredients go into it: a great launch video, a powerful interview, a provocative blog post, banger tweets, these all matter. But what also matters is having a team that can snap their fingers and execute it at the turnaround speed that startups need. The old agency SLA of 3 to 6 months to plan a launch is just archaic; you have to be able to execute all of this in a shockingly short period of time.

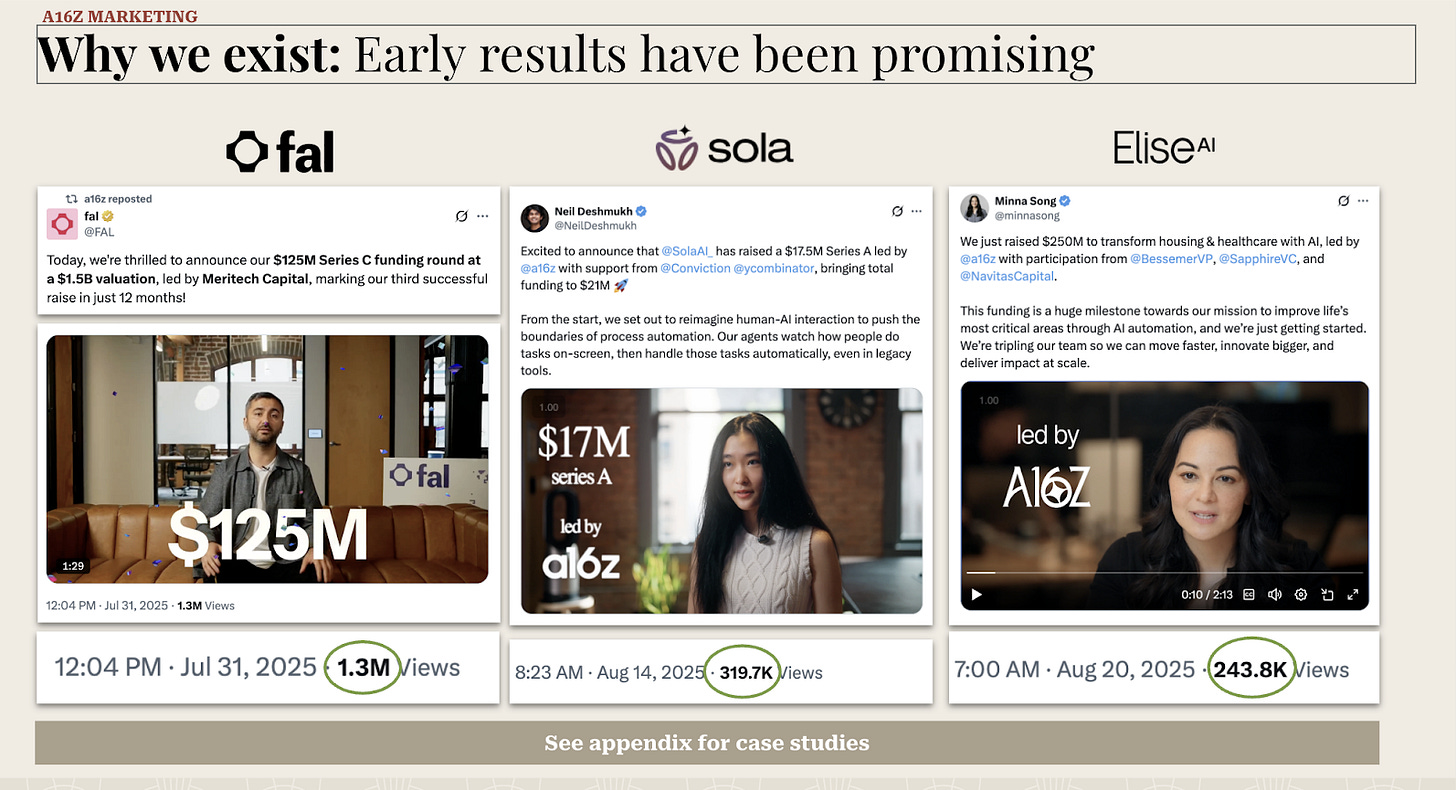

Every company tells a unique story, but there is a hard-learned formula to telling them right, and we’re going to make sure we get more reps than anybody else, and learn faster than anybody else. Since our earliest launches (like in the slide below), we’ve gotten good, fast; and more reps means more value the next time for our founders.

Taking “forward-deployed” to its logical conclusion

As we get really good at “win the day online”, one campaign at a time (“catching a fish”), the next logical thing we’ll do is teach our portfolio companies how to do this themselves (“teach them to fish.”) There are two ways to do this. One is with “Forward deployed New Media”, where team members embed themselves in portfolio companies for critical periods, and execute a launch together. The other, which is an exciting one we’re announcing today, is we’re going to help recruit and train the next generation of New Media, and help place them at portfolio companies.

This initiative, the New Media Fellowship, is how we really scale our impact across the whole a16z portfolio. We’re training a cohort of builders who know how to execute a timeline takeover, who can drop into a company, embed for a launch, and leave behind muscle memory for storytelling, distribution, and community. Over time, many will stay at those companies and rise up to influential positions, some will spin out, and some may even go on to start companies of their own, which we’d be excited to welcome back into the a16z family.

Ecosystem: the bottom-up vector of trust

Once you have a well-oiled New Media machine that can reach people on command, what do you do with that asset?

One of the most important things you can do with that asset to help founders and to help a16z is to reach the next cohort of great founders and key hires. Help the best people preferentially attach to our portfolio companies – and to a16z itself. Seeding that relationship, and building that trust, takes a long time. So we’re building an ecosystem team within New Media who is seeding the group chats, the dinners, the events, and the hidden networks that help talented and trusted people find each other and vouch for each other. And when the time comes, help each other find their next great challenge. You’ll be hearing more about this soon.

From David Booth: “I’m joining a16z”

All together: A16Z new media is the F1 Pit Crew of Venture

Venture is a team sport, but it’s not a team of equal participants. It’s a bit like Formula One. GPs are the drivers: they have to be great thinkers, great pickers, and great board members. And we want to augment them with the best pit crew in the business.

Media and brand building in venture is actually a lot like a pit crew’s job. You have to prepare over a long time, by building taste and authority to make good calls years in advance, and building trust with the ecosystem as they form a long-term relationship with you. And you also have to execute in the moment: turning around a critical video, launch campaign, or timeline takeover has to be executed perfectly, instantly, every time - like changing a tire mid-race.

And it’s like F1 for one more very important reason: which is everything downstream from raceday. The most amazing thing about F1 is how it inspires, organizes and tests the very best of our design and manufacturing ability, for the downstream benefit of all car manufacturers and drivers. We want every New Media production to serve the same role, but for building great tech companies: not only within the a16z family, but for all of tech. Because we’re all on the same team, which is team progress - and that’s what we celebrate.

If you made it to the end of this post, we’d love to hear from you about the a16z New Media Fellowship: whether you’re interested in it, or you know someone who’d be perfect. We’re also hiring for full-time roles, for podcast production, writing, social media, video, research, comms, marketing, portfolio support, events, and other community functions. The team is growing fast, so if this is the opportunity you’re looking for, get in touch.

Views expressed in “posts” (including podcasts, videos, and social media) are those of the individual a16z personnel quoted therein and are not the views of a16z Capital Management, L.L.C. (“a16z”) or its respective affiliates. a16z Capital Management is an investment adviser registered with the Securities and Exchange Commission. Registration as an investment adviser does not imply any special skill or training. The posts are not directed to any investors or potential investors, and do not constitute an offer to sell — or a solicitation of an offer to buy — any securities, and may not be used or relied upon in evaluating the merits of any investment.

The contents in here — and available on any associated distribution platforms and any public a16z online social media accounts, platforms, and sites (collectively, “content distribution outlets”) — should not be construed as or relied upon in any manner as investment, legal, tax, or other advice. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Any charts provided here or on a16z content distribution outlets are for informational purposes only, and should not be relied upon when making any investment decision. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. In addition, posts may include third-party advertisements; a16z has not reviewed such advertisements and does not endorse any advertising content contained therein. All content speaks only as of the date indicated.

Under no circumstances should any posts or other information provided on this website — or on associated content distribution outlets — be construed as an offer soliciting the purchase or sale of any security or interest in any pooled investment vehicle sponsored, discussed, or mentioned by a16z personnel. Nor should it be construed as an offer to provide investment advisory services; an offer to invest in an a16z-managed pooled investment vehicle will be made separately and only by means of the confidential offering documents of the specific pooled investment vehicles — which should be read in their entirety, and only to those who, among other requirements, meet certain qualifications under federal securities laws. Such investors, defined as accredited investors and qualified purchasers, are generally deemed capable of evaluating the merits and risks of prospective investments and financial matters.

There can be no assurances that a16z’s investment objectives will be achieved or investment strategies will be successful. Any investment in a vehicle managed by a16z involves a high degree of risk including the risk that the entire amount invested is lost. Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by a16z is available here: https://a16z.com/investments/. Past results of a16z’s investments, pooled investment vehicles, or investment strategies are not necessarily indicative of future results. Excluded from this list are investments (and certain publicly traded cryptocurrencies/ digital assets) for which the issuer has not provided permission for a16z to disclose publicly. As for its investments in any cryptocurrency or token project, a16z is acting in its own financial interest, not necessarily in the interests of other token holders. a16z has no special role in any of these projects or power over their management. a16z does not undertake to continue to have any involvement in these projects other than as an investor and token holder, and other token holders should not expect that it will or rely on it to have any particular involvement.

With respect to funds managed by a16z that are registered in Japan, a16z will provide to any member of the Japanese public a copy of such documents as are required to be made publicly available pursuant to Article 63 of the Financial Instruments and Exchange Act of Japan. Please contact compliance@a16z.com to request such documents.

For other site terms of use, please go here. Additional important information about a16z, including our Form ADV Part 2A Brochure, is available at the SEC’s website: http://www.adviserinfo.sec.gov

You do realize that this is PR, not media. You are talking your own book and pushing your own agenda. Don’t disparage the work of real journalists by placing yourselves in that bucket. Until you actually approach such things in an unbiased and fact-centered way, you are just creating a very sophisticated PR operation.

Wow. Brilliant. a16z’s best initiative.