Charts of the Week: Code Gen Strikes Back

Plus: AI & Unemployment; Valuations vs. Performance; Data Centers are Getting Huge

| America | Tech | Opinion | Culture | Charts |

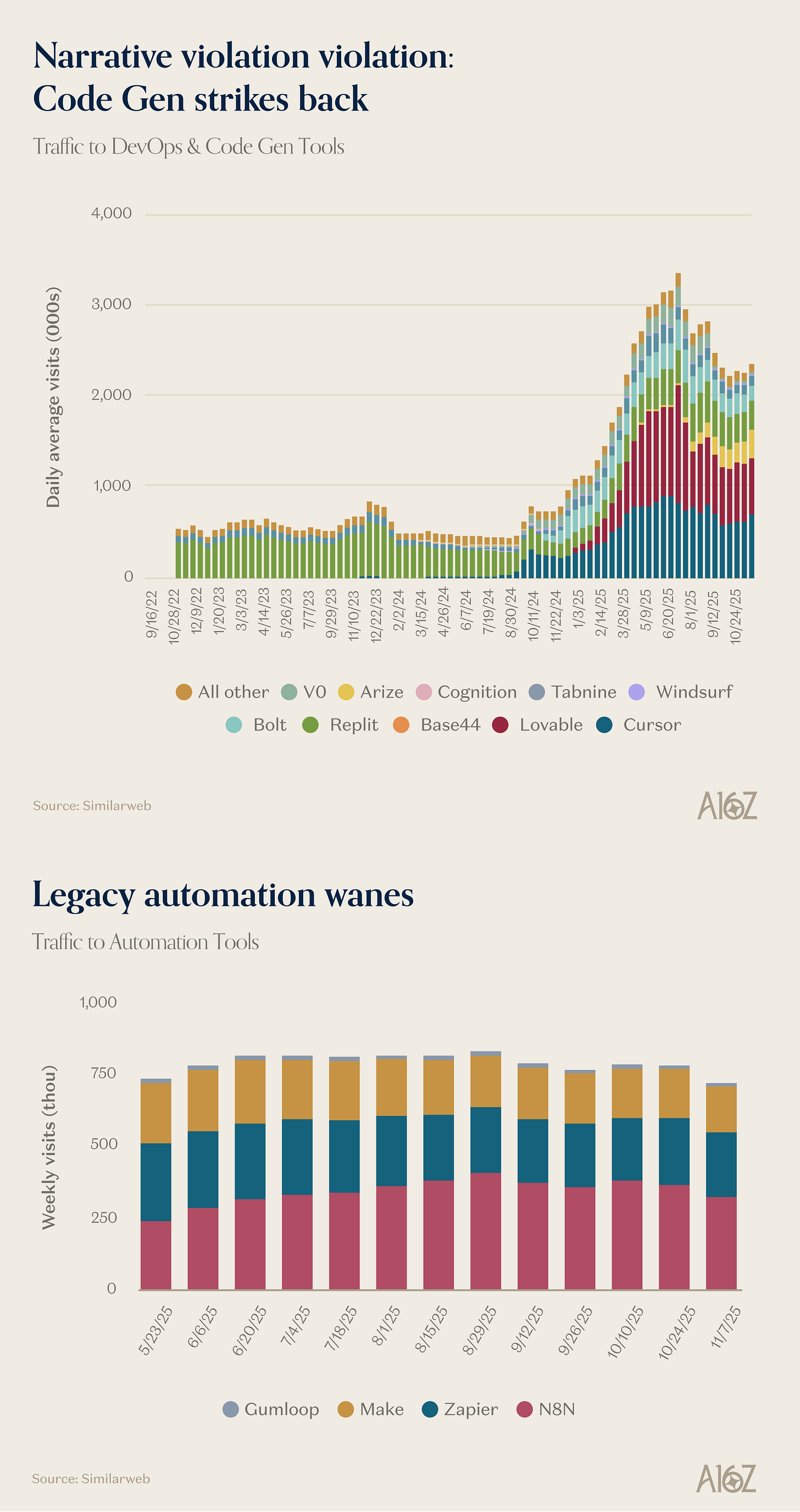

Narrative violation violation

From June through September, it appeared as though traffic for AI “vibe coding” tools was ‘collapsing’ off the Spring peak.

That downward trend seems over (for now, at least). Webtraffic (which is notoriously noisy) is rising again for DevOps and Code Completion Tools, led primarily by Cursor (of $1B ARR in less than two years fame)

At the same time as the AI code-gen web traffic crisis appears to be over, AI may be creating a new crisis for other parts of the internet, in this case, traditional saas. Traffic to mainstay automation platforms, like Zapier and N8N, has been flat-to-down since the summer, with a substantial drop in November.

Truthfully, the biggest takeaway here is that clickstream data is noisy, and it’s probably a mistake to get worked up over MoM shifts (one way or another). In the latest read, code-gen traffic is back on the rise, while traditional automation tools seem to be on the wane. That certainly fits a narrative, and if the data holds up over a longer period, it might even count as a trend.

But for now, it’s just a fun observation.

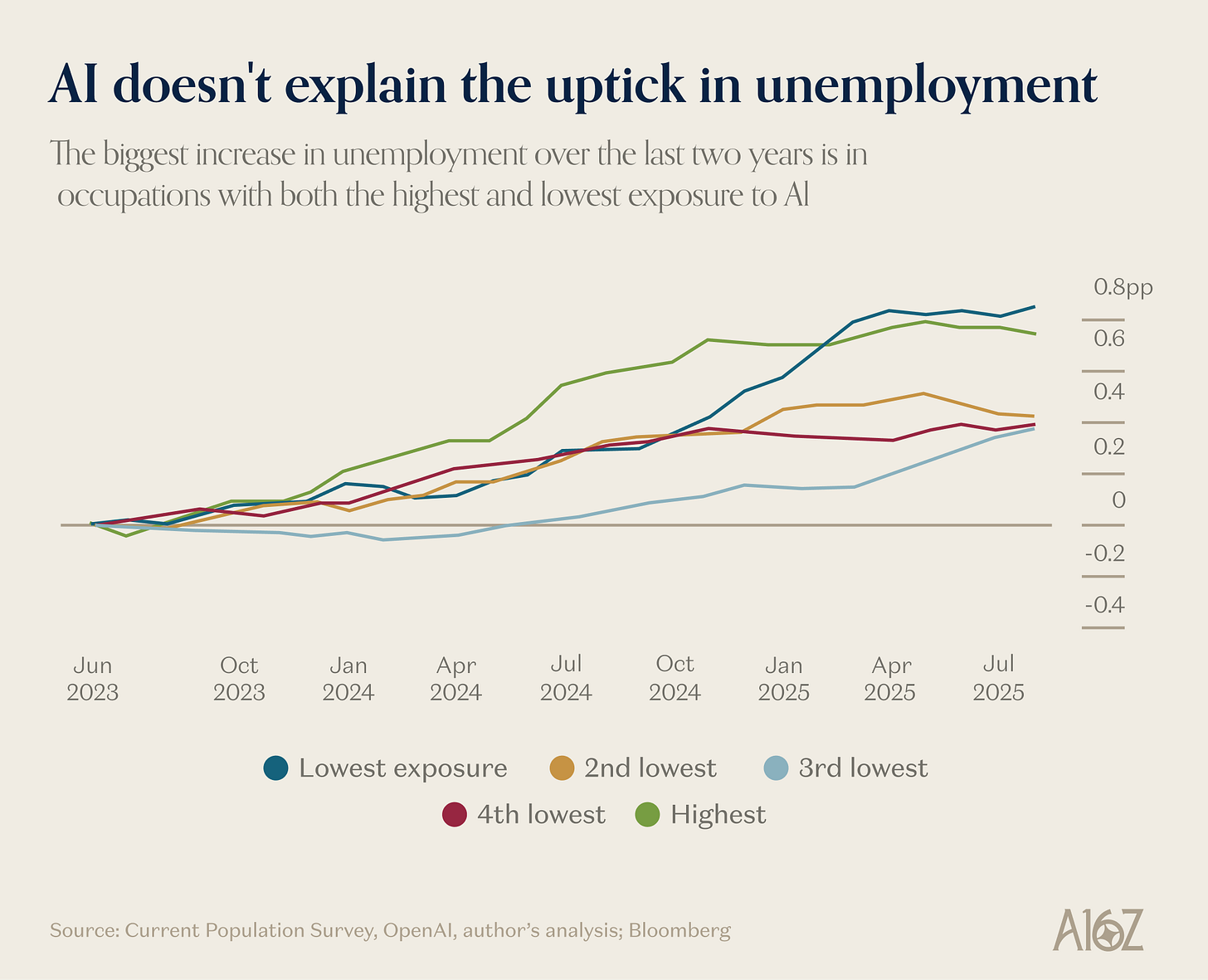

AI isn’t (likely) to blame for unemployment

The occupations with the biggest recent increase in unemployment also happen to be the least exposed to AI (as assessed by OpenAI).

The second biggest increase, however, are the occupations most exposed to AI (again, as assessed by OpenAI).

If AI was taking all the jobs, this isn’t exactly the trend you’d expect to see, but it’s not not the trend you’d expect to see, either. You could squint and say “AI’s made life harder for the marginal software engineer, but clearly there are other forces at play,” but even then, you’d be speculating.

The reality is that the data around “AI took my job” is pretty mixed (at best), which is consistent with the messy picture above. There are lots of cyclical factors at-work here, and the biggest hit to software and tech jobs, for example, certainly wasn’t ChatGPT, but rising interest rates. There’s also evidence that AI has been a relative boon to hiring, especially insofar as AI has captured the lion’s share of new investment (and hiring is downstream of capital flows), and not just in VC.

In all events, mind the narrative, keep an open mind, and know that it’s going to take some time before it all plays out (most likely, in unpredictable ways).

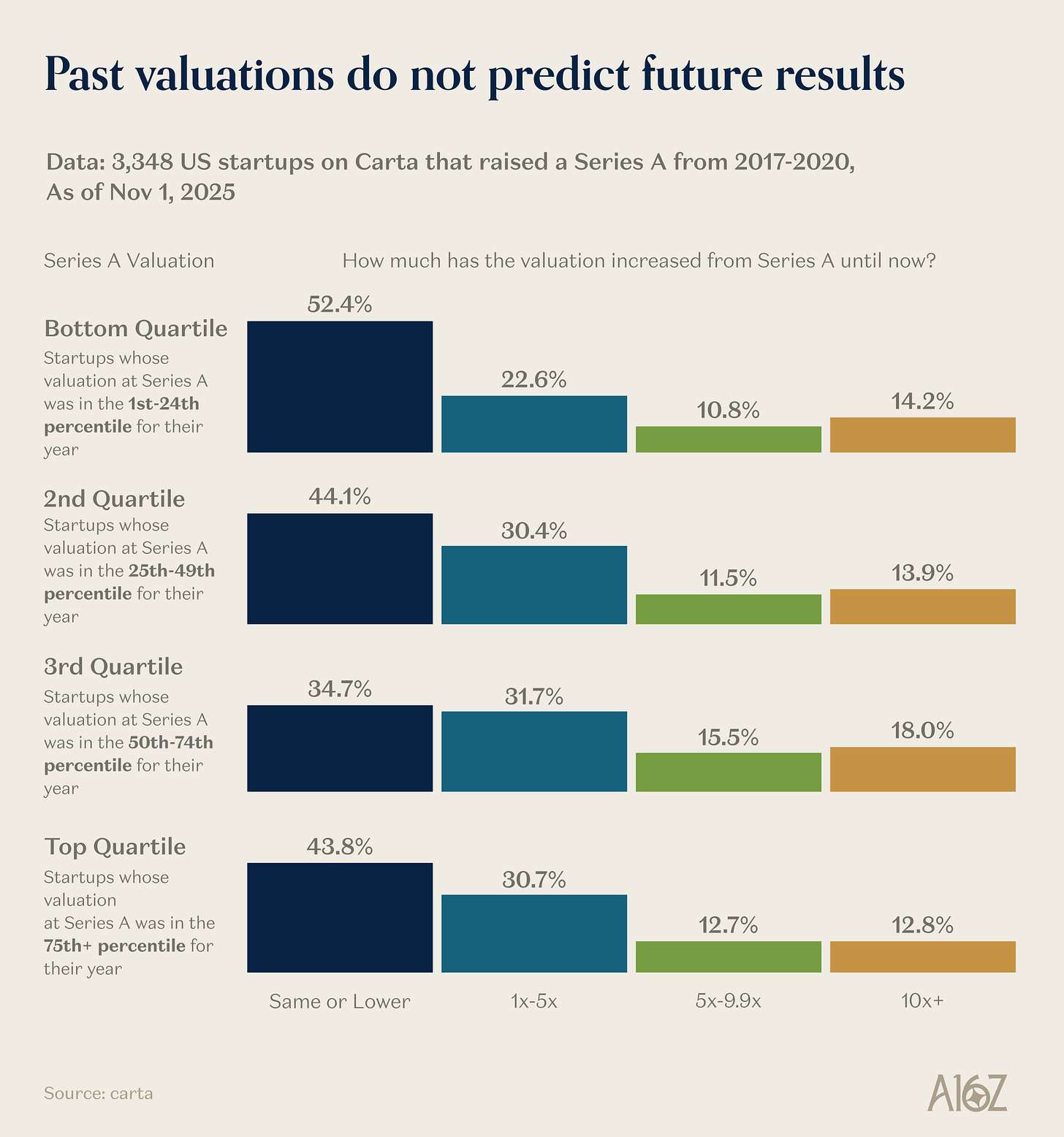

Past valuation does not predict future results

Based on data from Carta, there doesn’t appear to be a lot of correlation between the priciness of an A round, and future markups (but maybe there’s some)

While the lowest quartile A valuations has the highest incidence of flat-or-down rounds (bad), it also has the second-highest incidence of 10x+ outcomes (good)

At the other end of the spectrum, the highest quartile As has the second-most 5x-10x outcomes (good), but the fewest 10x+ (less good).

In some ways, the sweet-spot is the second-highest quartile, which has the lowest share of flat-to-down outcomes, combined with the highest share of 5x-10x+.

The way venture works is that the winners really win. For a true rocketship, pretty much any Series A price makes sense . . . but, it’s also fair to say that price does matter. Generating a 10x return off the highest base is a bit harder than generating a 10x return off a slightly lower base.

Go figure.

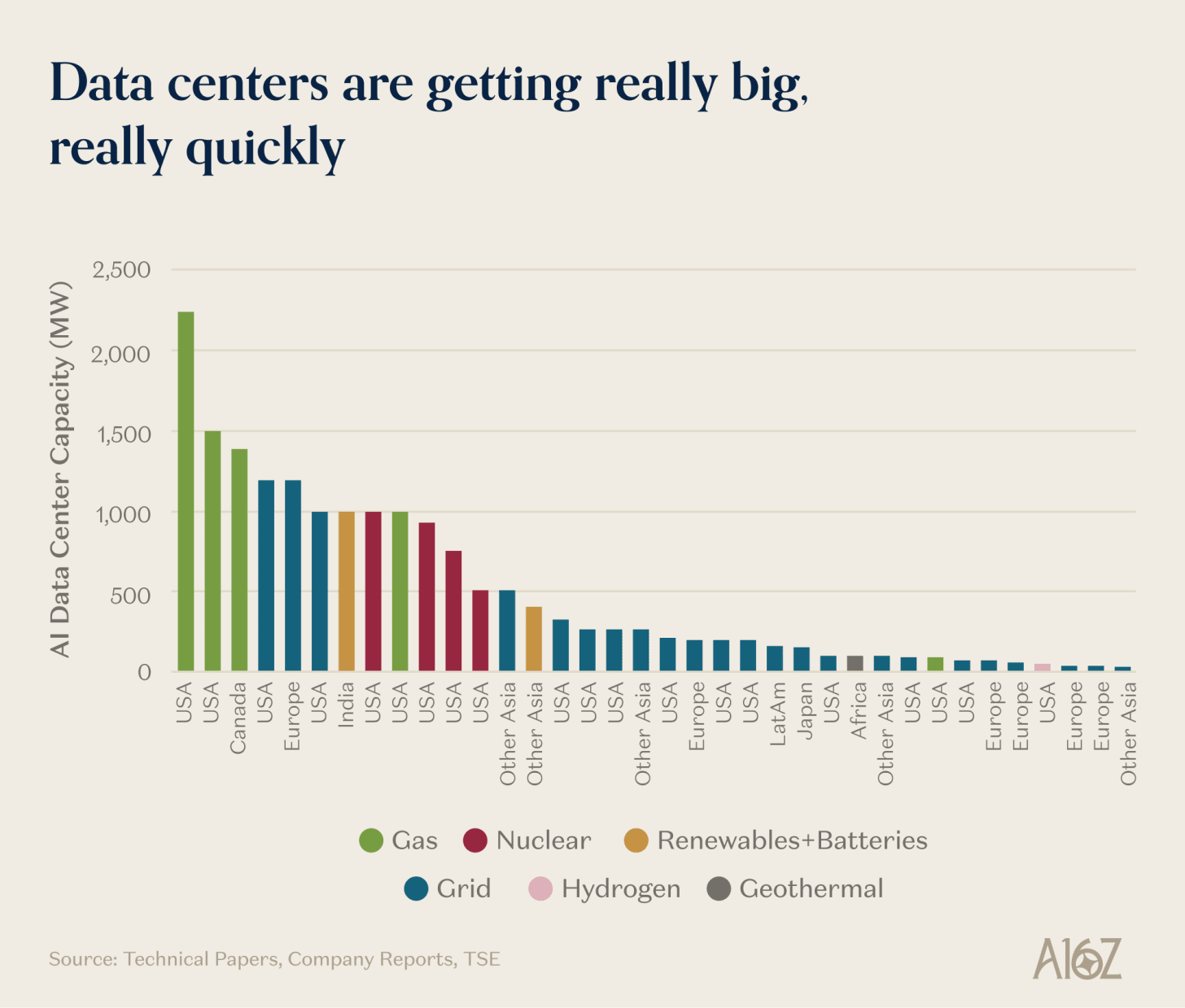

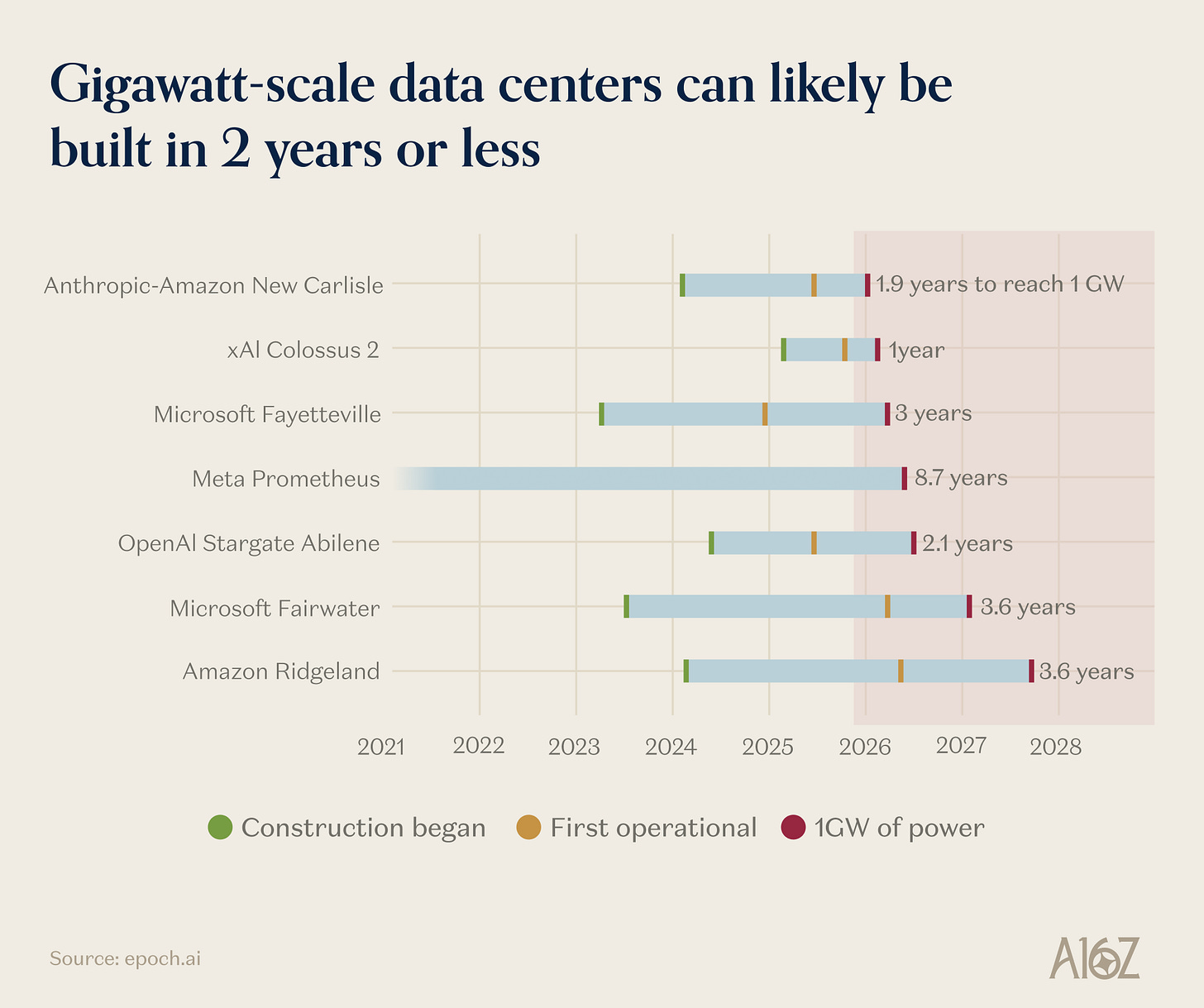

Data centers are getting really big, really quickly

Data centers are getting really huge, with the largest ones under development in the 1-2 GW range. That’s roughly enough energy to power 1 million homes (according to EpochAI), and at least five of these 1GW+ data centers are expected to come online in 2026.

We’re also building these high power data centers more quickly than ever. xAI’s Colossus 2, which is already operational, is expected to reach 1GW scale by next year–that would make it just 12 months from start to finish to reach that milestone.

Thing one, with all this data center coming online, we’re going to need a lot of energy. That we already knew. Thing two, who said we can’t build things anymore?! We can, we have, and we will. Bigger, stronger, faster.

This newsletter is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. Furthermore, this content is not investment advice, nor is it intended for use by any investors or prospective investors in any a16z funds. This newsletter may link to other websites or contain other information obtained from third-party sources - a16z has not independently verified nor makes any representations about the current or enduring accuracy of such information. If this content includes third-party advertisements, a16z has not reviewed such advertisements and does not endorse any advertising content or related companies contained therein. Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z; visit https://a16z.com/investment-list/ for a full list of investments. Other important information can be found at a16z.com/disclosures. You’re receiving this newsletter since you opted in earlier; if you would like to opt out of future newsletters you may unsubscribe immediately.