Charts of the Week: Fully scaled agents

Fully scaled agents; Access control, unlocked; GPUs for rent; Down with down rounds

| America | Tech | Opinion | Culture | Charts |

Help wanted: fully scaled agents

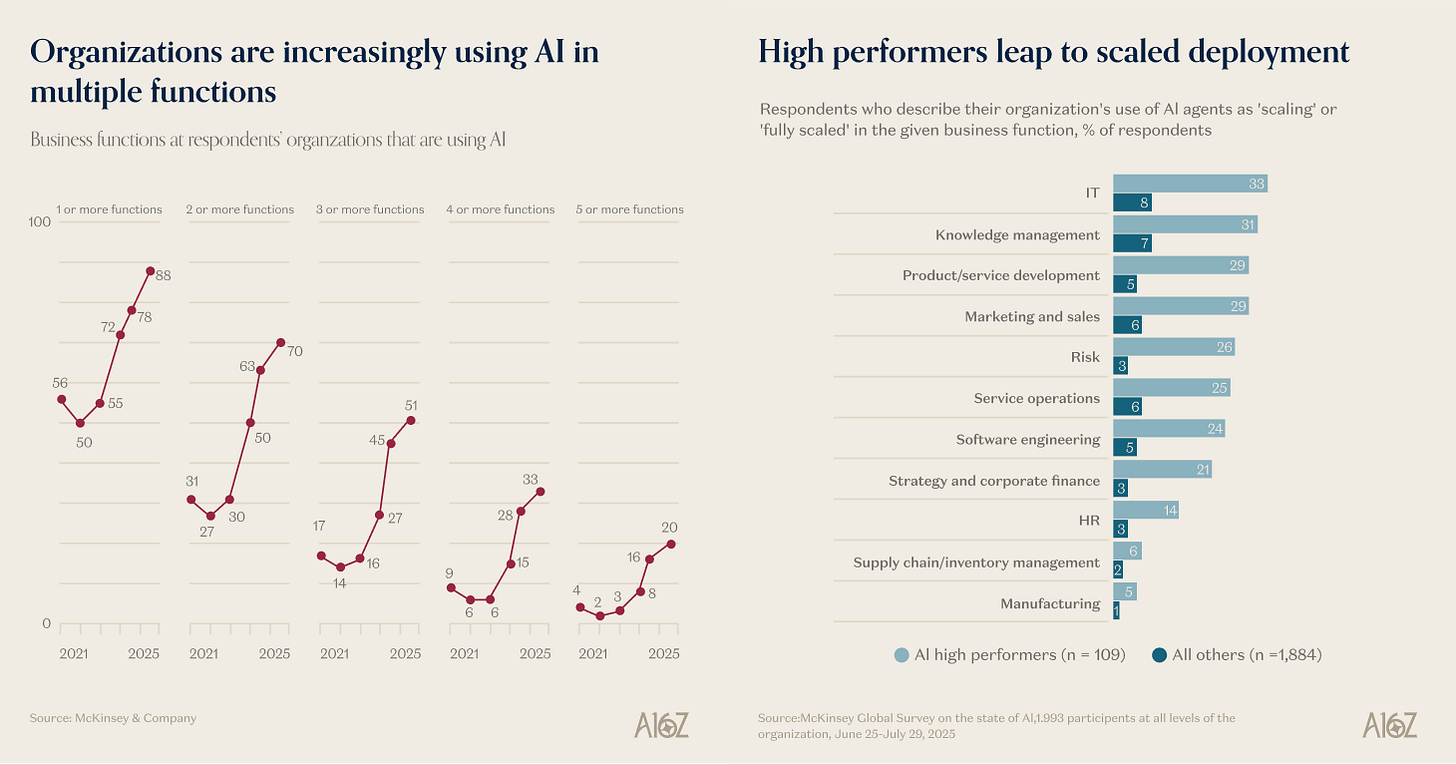

A majority of orgs are now implementing AI across three or more functions, according to a recent McKinsey survey, although the degree of implementation varies a good deal.

AI agents are popular in testing and development, but only a small fraction are operationally “fully scaled.” The exceptions are the power users (the ~6% of respondents who report a 5% EBIT impact from AI), who are not only slightly ahead of the field, but 3-5x more likely to have a “scaled or fully-scaled” agent at work.

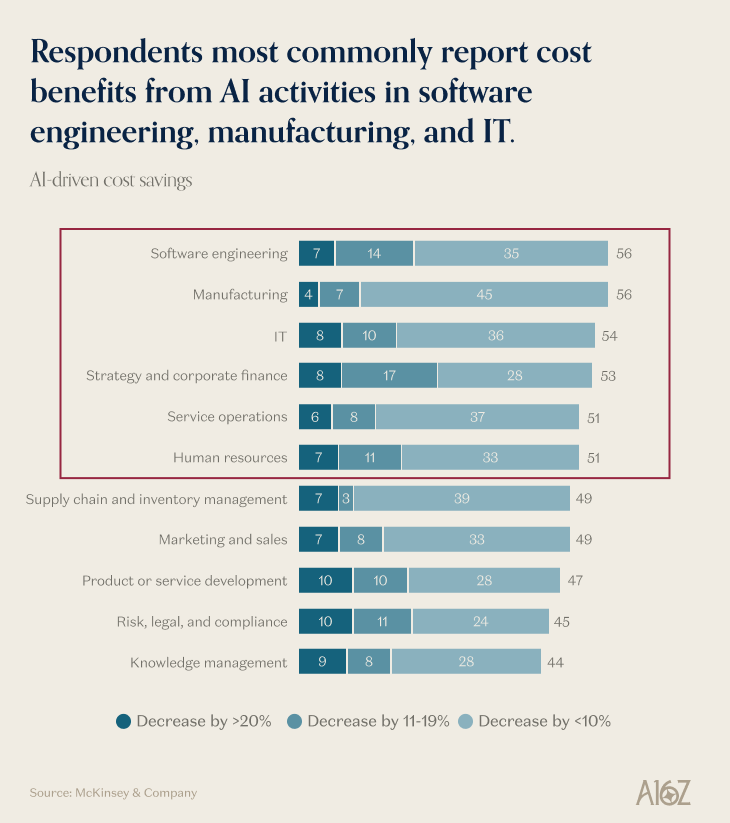

In terms of which parts of the org are seeing the most productivity gains from AI, manufacturing is a surprising early standout, with a majority of respondents already reporting meaningful cost savings.

A couple of things to note here (other than this is a survey, so discount accordingly). One, implementation is proliferating rapidly, but it’s still so early—GPUs are already melting with less than 2% of agents reportedly “fully scaled,” so one can only imagine what comes next. Two, mind the compounding exponentials: a small subset of firms is investing a lot more in AI and getting a lot more out of AI than the rest. The performance gap could widen in a hurry. Three, did we mention that it’s just so early?

Access control, unlocked

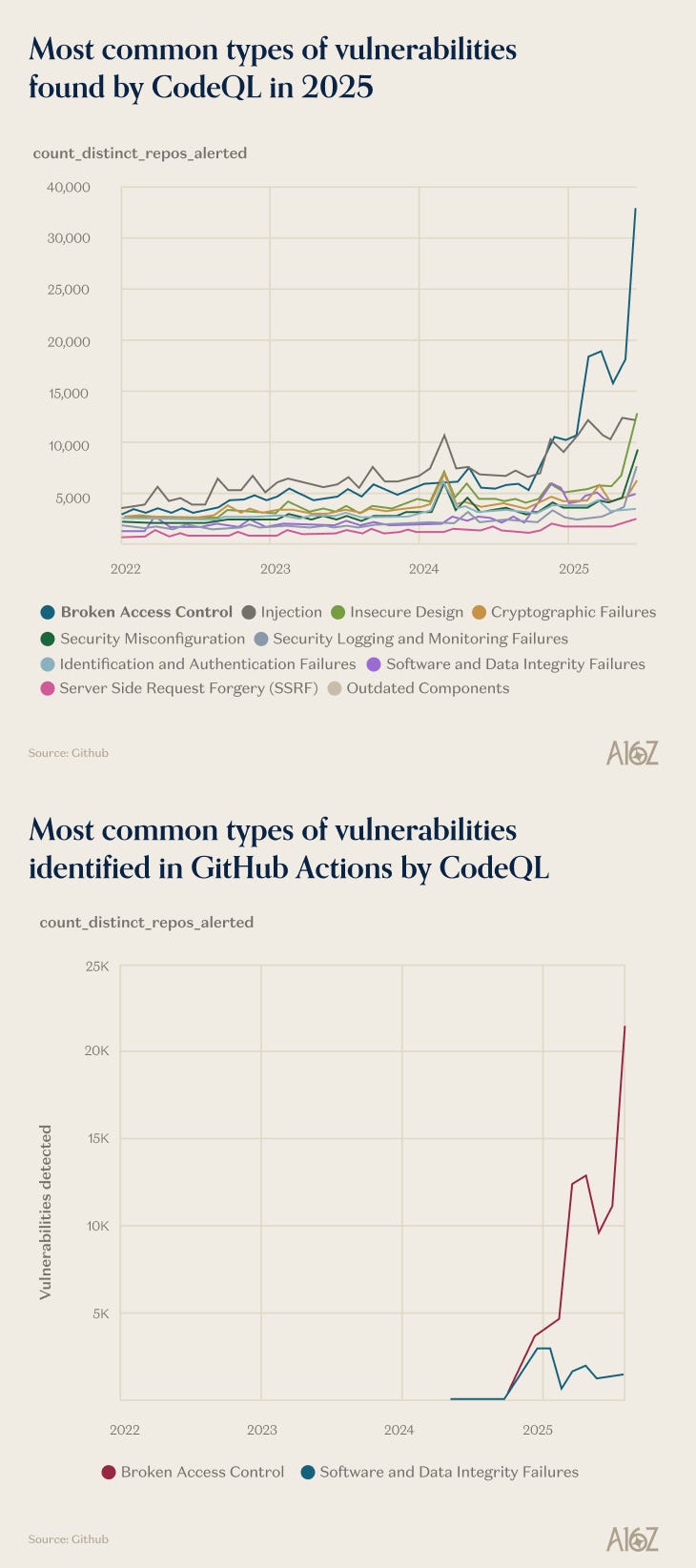

The most common vulnerability identified by Github’s CodeQL is “broken access control” and it’s not even close

The spike in vulnerability took off around Q4 ‘24 and does not appear to have looked back.

Is this vibe coding? Probably. Vibe coding tends to prioritize fast and local, rather than thorough and systemic. Access-control errors hide in the gaps between the components, which is precisely where vibe-coding is weakest (for now). Have fun out there, kids, but stay safe, and mind those access controls.

GPUs for rent

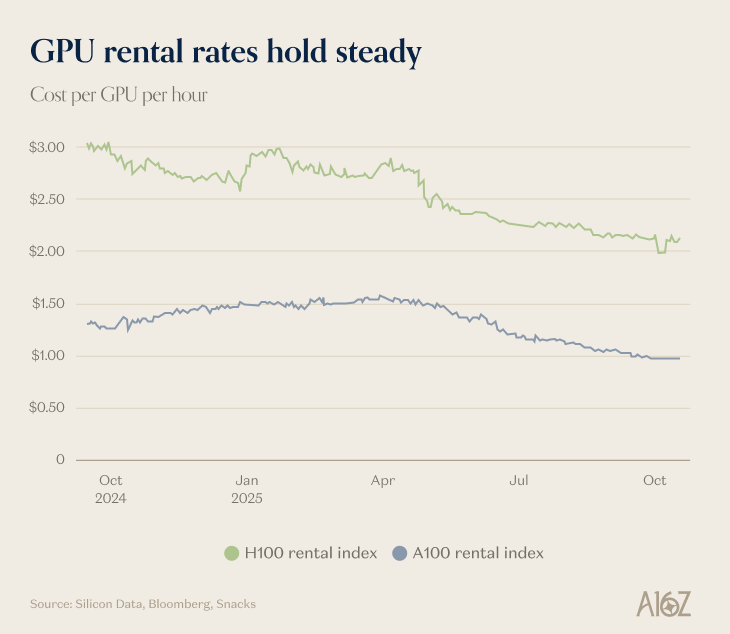

Prices to rent H100 and A100 GPUs dropped over the Spring and Summer, but appear to have stabilized recently.

Coreweave also reported that H100 customers were re-upping contracts at only 5% less than the original value.

The depreciation schedule for GPUs has become a hot topic of late, with some notable bears (i.e. Michael Burry of Big Short fame) questioning whether customers will continue to pay for older GPUs, as newer models come to market.

Truly standardized pricing data for GPUs is hard to capture, because rental terms are not apples-to-apples—how much you pay depends a lot on how much you want, for how long, and at what times. That said, based on some of the best efforts at standardizing pricing, it appears that there is still demand for the older, less-powerful A100 GPUs.

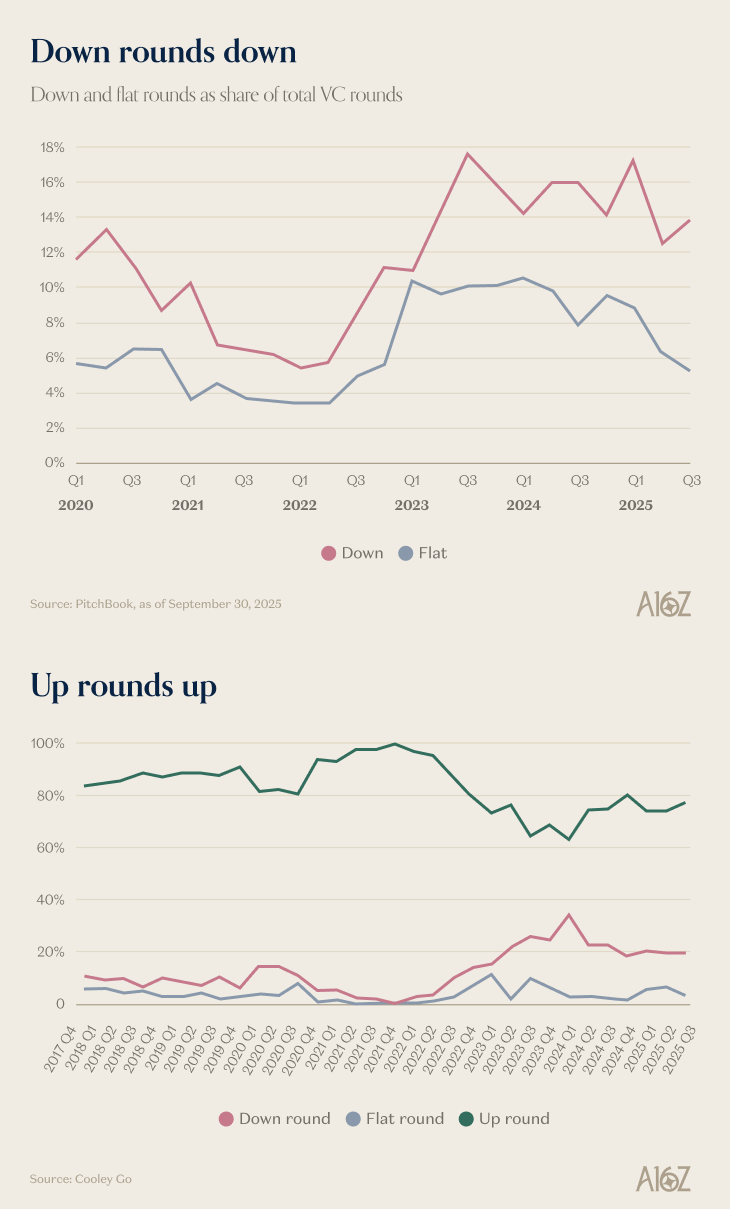

Down with down rounds

Data on venture financing shows that both down- and flat-rounds are declining in overall share (while up-rounds continue to climb)

Both down- and flat-rounds rose dramatically when rates went up in ‘22-’23, and while they’re still elevated, it appears that the cycle is turning.

December is historically one of the most active months for VC deal activity, so the real “moment of truth” isn’t in the data yet, but for now, you love to see it.

This newsletter is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. Furthermore, this content is not investment advice, nor is it intended for use by any investors or prospective investors in any a16z funds. This newsletter may link to other websites or contain other information obtained from third-party sources - a16z has not independently verified nor makes any representations about the current or enduring accuracy of such information. If this content includes third-party advertisements, a16z has not reviewed such advertisements and does not endorse any advertising content or related companies contained therein. Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z; visit https://a16z.com/investment-list/ for a full list of investments. Other important information can be found at a16z.com/disclosures. You’re receiving this newsletter since you opted in earlier; if you would like to opt out of future newsletters you may unsubscribe immediately.