Best of the Best of Mobile

The best charts from Sensor Tower's 2026 State of Apps

| Nation | Tech | Opinion | Culture | Charts |

A little meander through Sensor Tower’s State of Mobile 2026 Report. We pulled out what we found most interesting and delightful for your viewing pleasure.

1. YouTube to rule them all

Youtube is the top app for everyone:

As streaming time (and monetization) continues to grow, YouTube is the top app in the US by share of audience across every age group (and is top for both Men and Women)

Facebook and Insta, for their parts, have inverse trends with respect to age. Facebook is increasingly popular the older you get, while Instagram is the opposite

TikTok is Top10 for the youngest and the oldest, but is nowhere to be found in the middle ages. When you’re young, you spend time on Discord and Snapchat . . . but then the Walmart app takes over.

As for gender splits, the majority of apps are the same for both, but ChatGPT, Discord, and Reddit are Top 10 for men, while Pinterest, TikTok and Venmo are Top 10 for women.

There’s no big surprise here.

For all ages and genders, YouTube (and Insta) continues to rise as a platform for attention (and short-form video, as a medium for attention). That Reddit and Discord skew male . . . well, you didn’t need a chart to tell you that.

2. Apps > Games

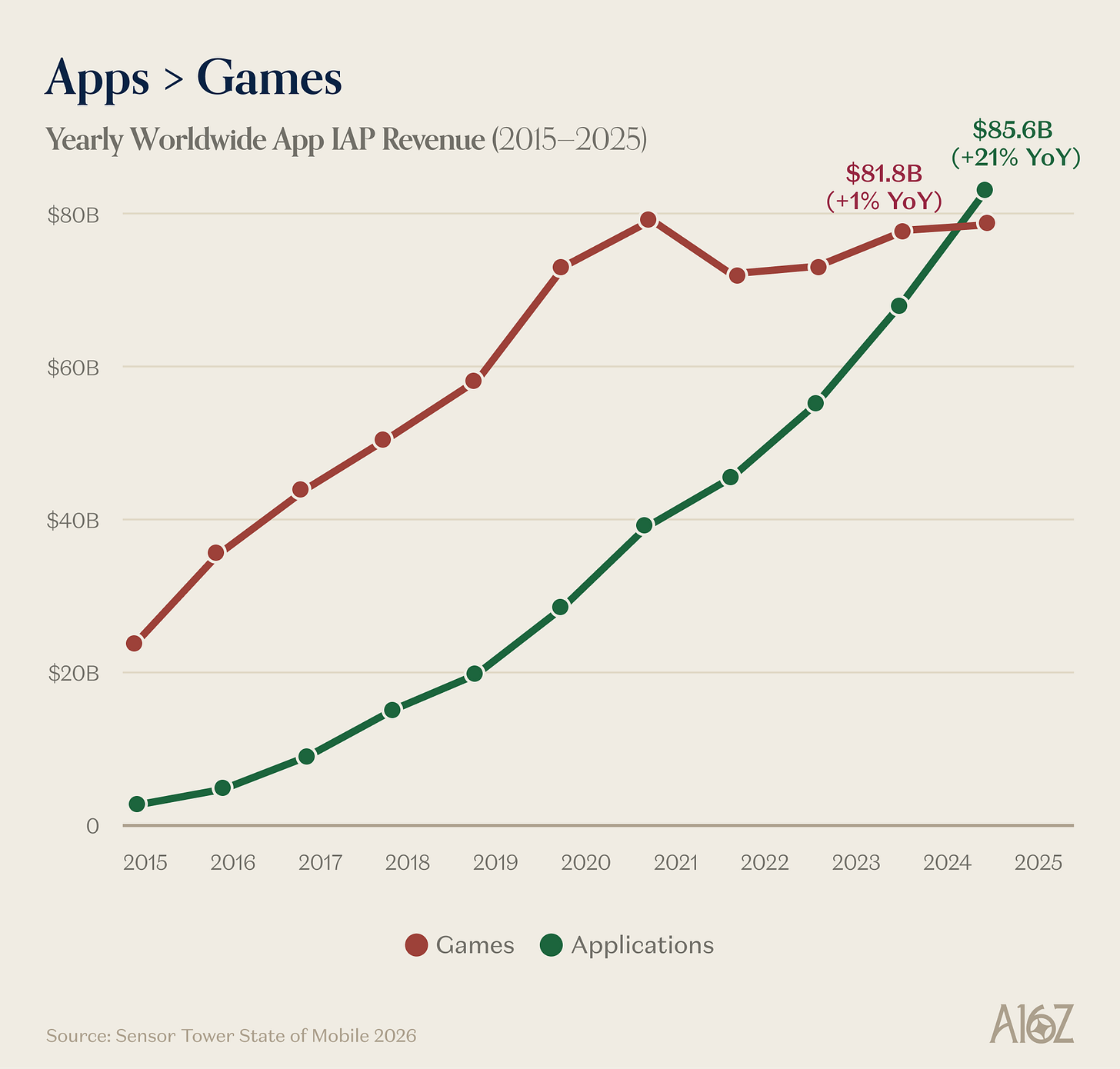

For the first time on mobile, worldwide app revenues (by In-App Purchases (IAP)) exceeded game revenues:

In-app revenues for apps hit $85.6B (growing 21% YoY) for 2025, passing the $81.8B for in-app game revenue.

It’s a pretty remarkable changing of the guard, considering in-app game revenue was basically 2X app revenue only 4 years ago.

The closed-gap is partly a function of accelerating app revenue growth (led by GenAI apps), but mostly it’s because game revenue has been pretty flat since it hit its peak in 2021. Good for apps, and not so good for games, I suppose.

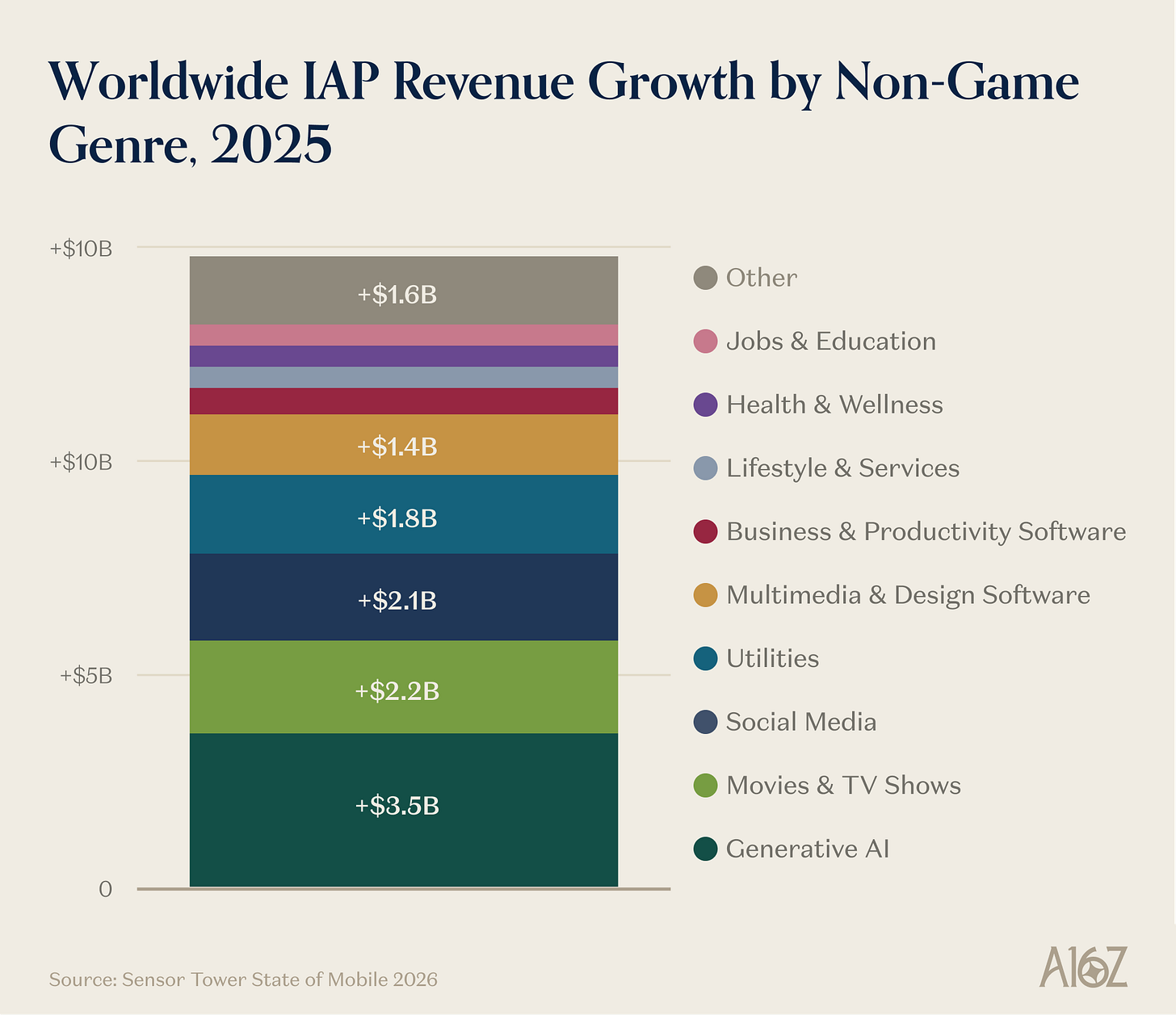

GenAI led app revenue growth, by adding $3.5B in 2025.

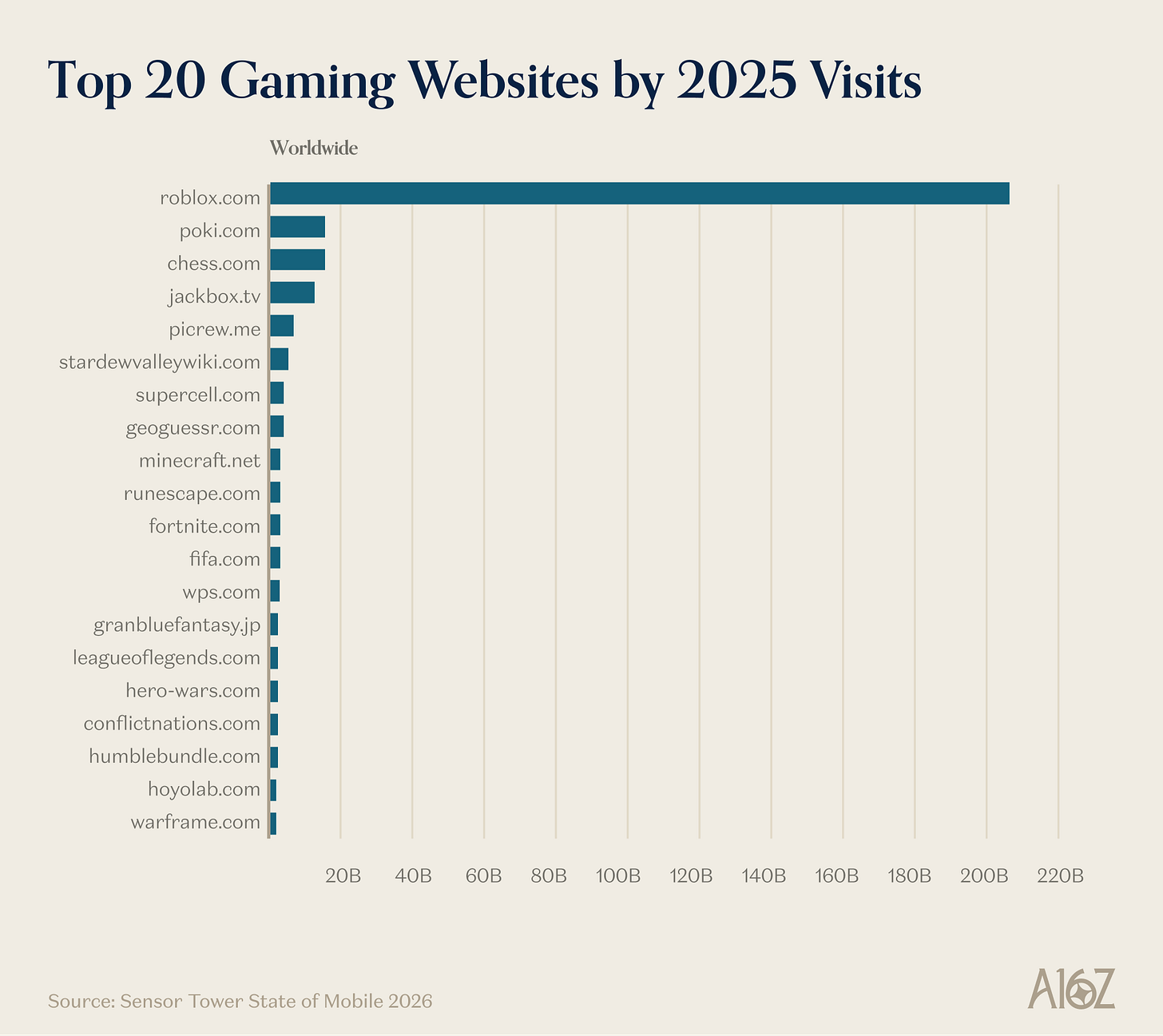

In terms of who sits atop the games leaderboard, there is a clear #1, and then there’s the rest of the field:

Roblox is the undisputed global champ of site visits, capturing ~75% of all visits to game publisher sites.

3. AI’s Mobile-Led Charge

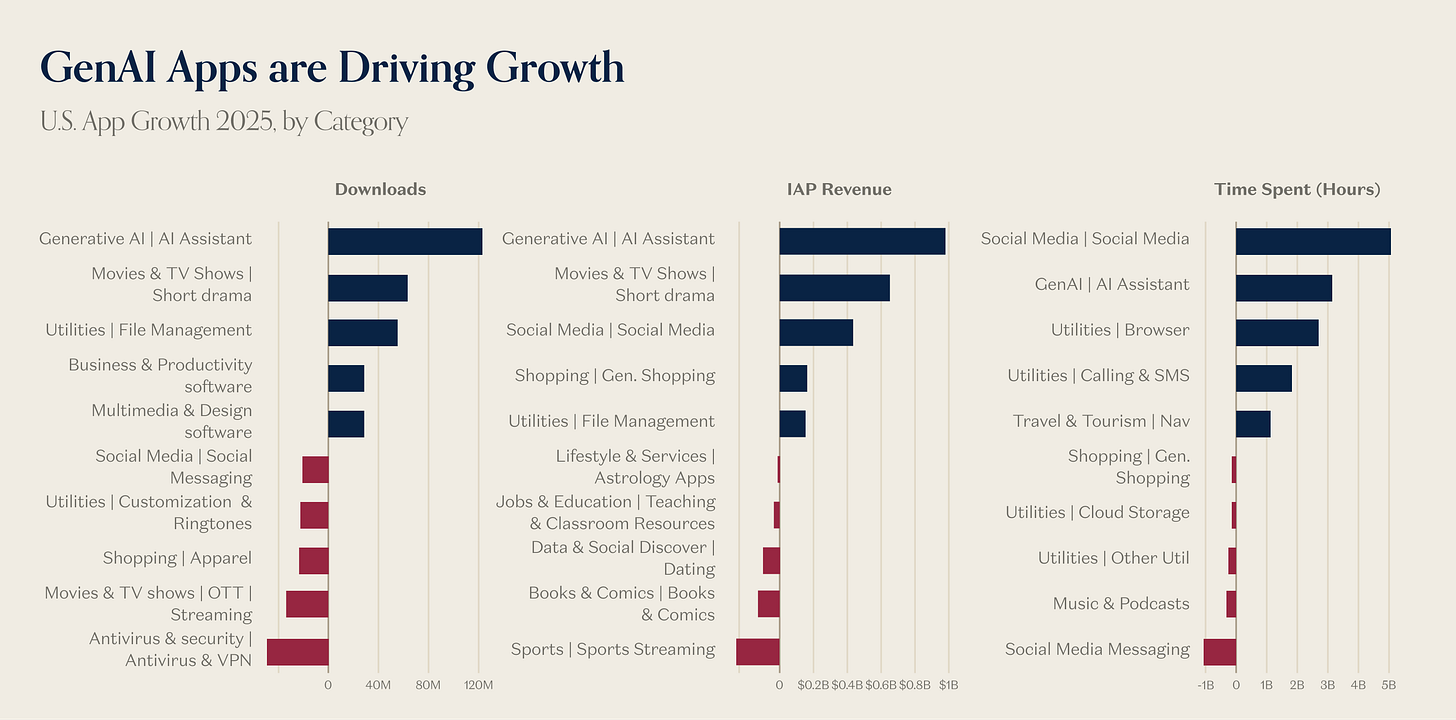

Speaking of AI apps, they’re growing very quickly:

GenAI apps added the most downloads, the most In-App Purchase revenue, and the second most time-spent (after social media).

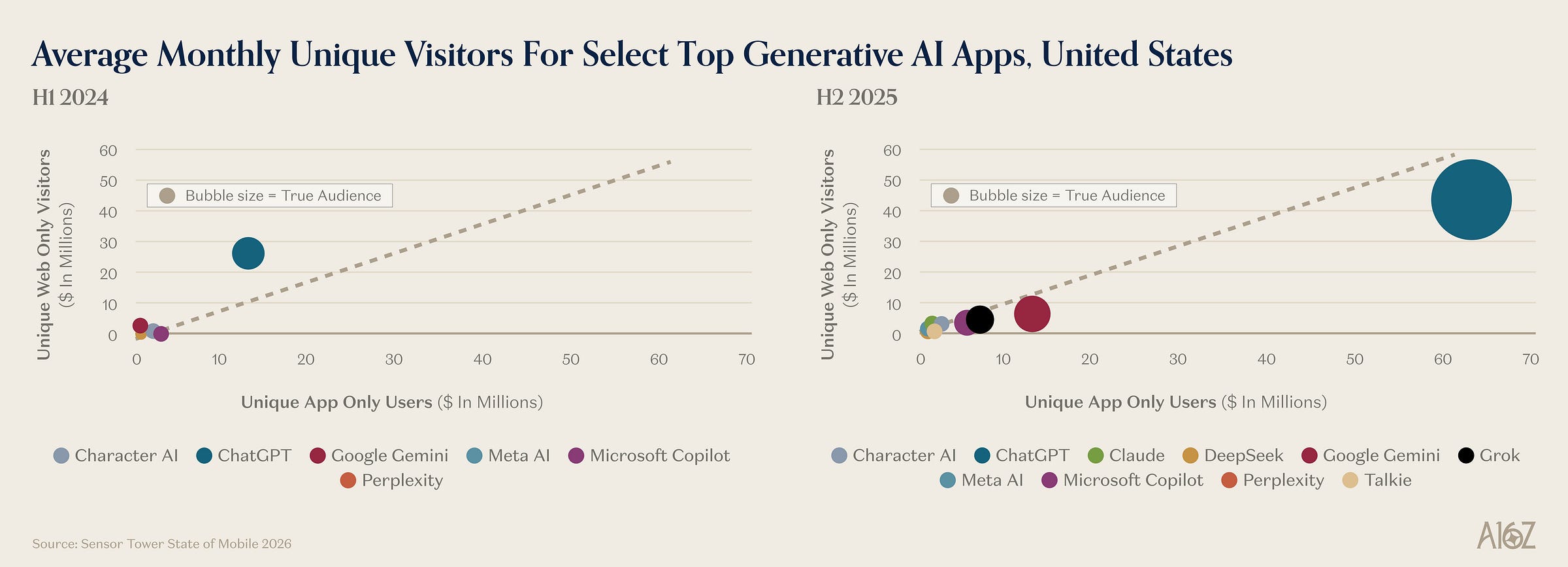

To get a sense of how quickly GenAI app usage is growing, consider the change in audience size for GenAI apps from the first half of ‘24 to the second-half of ‘25.

Not only has the audience grown massively, but mobile has become the primary gateway to growth:

The total “true audience” for GenAI (defined as the sum of users across the top 10 GenAI assistants) surpassed 200M in the US by the end of ‘25—and more than half of users (110M) used mobile to get there. That compares to the 13M mobile users in ‘24 (out of the ~45M total).

People really like AI on their phones.

4. AI coming for search traffic

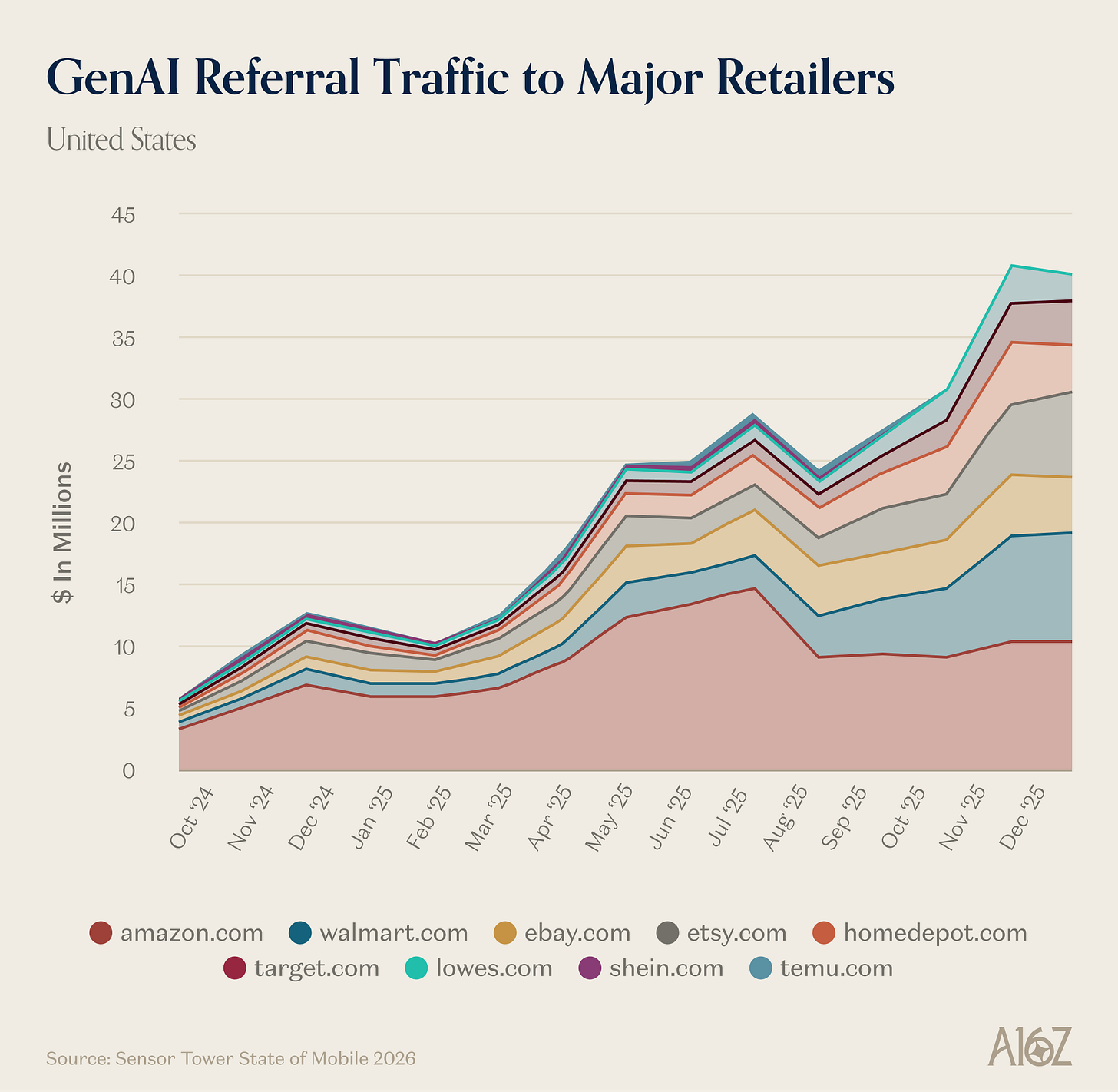

The other thing that people like to do with AI is shop.

Referral traffic from GenAI to major retail sites has grown by ~7X since Oct. 24:

Walmart, Etsy, Home Depot, and Target have been the biggest beneficiaries of AI-driven traffic, with referrals growing ~1600%.

As a share of overall retail traffic, AI referrals are still less than 1% of total, but it’s hard to see this train stopping anytime soon (unless and until AI starts doing the shopping itself, in which case, it’s just a whole new ballgame entirely).

That’s where AI is sending customers. But this too, is kind of fun.

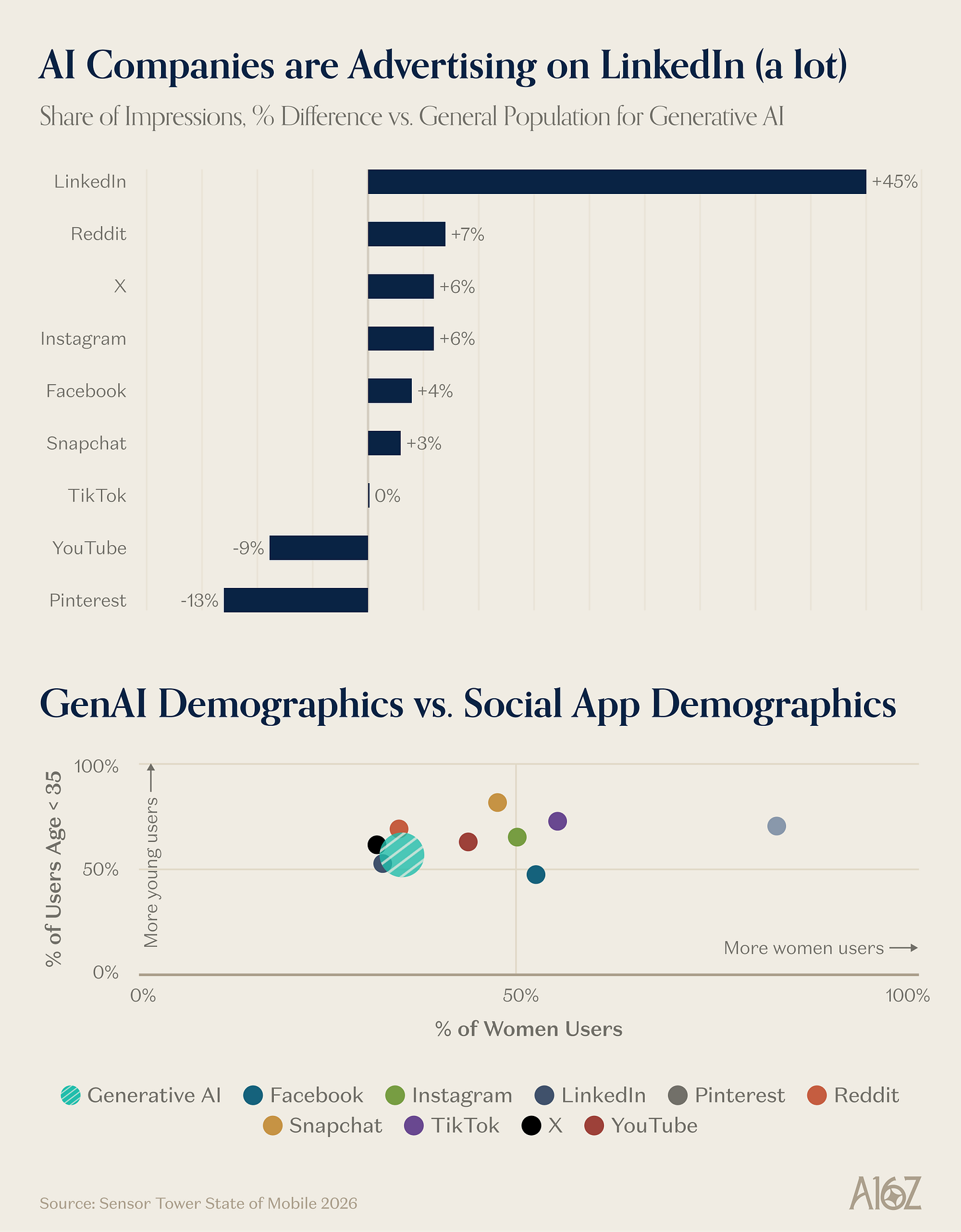

Where does AI itself advertise for new users? LinkedIn, apparently:

Ad impressions for AI skew heavily to LinkedIn (and Reddit and X, to a much lesser extent).

Why would GenAI apps favor LinkedIn as an acquisition channel?

Well, one possibility (as per the chart) is that GenAI skews younger and male, and so does LinkedIn (and Reddit and X). Go where your audience is, etc. etc. Plus, the race for the Enterprise/Business-User is still very much on, and perhaps LinkedIn is the considered the place to find them.

5. Waymore Waymo

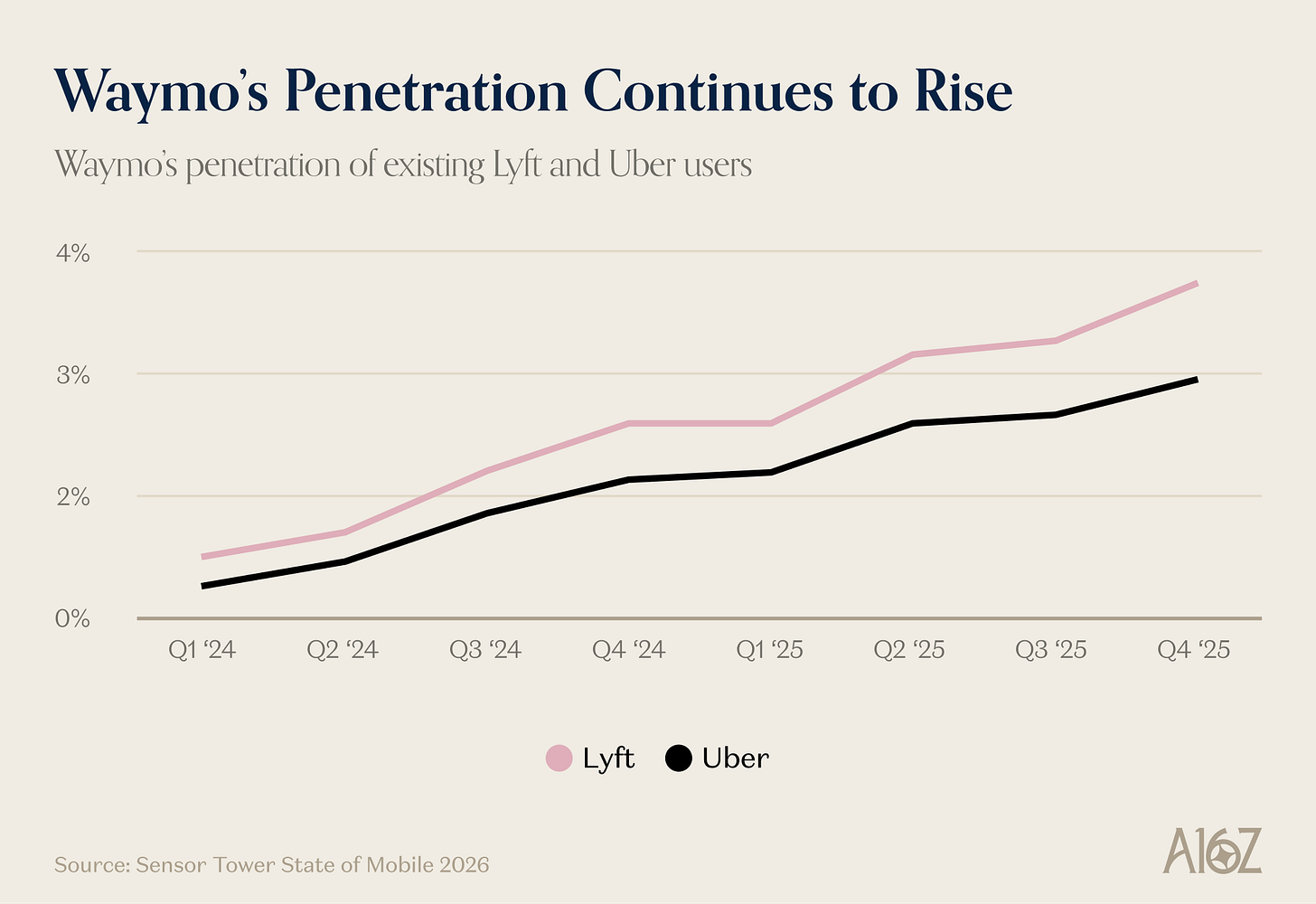

And finally, the data has spoken: self-driving cars continue their ascent:

As of Q4, Waymo’s penetration of Lyft and Uber’s userbase has steadily risen to ~4% and 3% respectively.

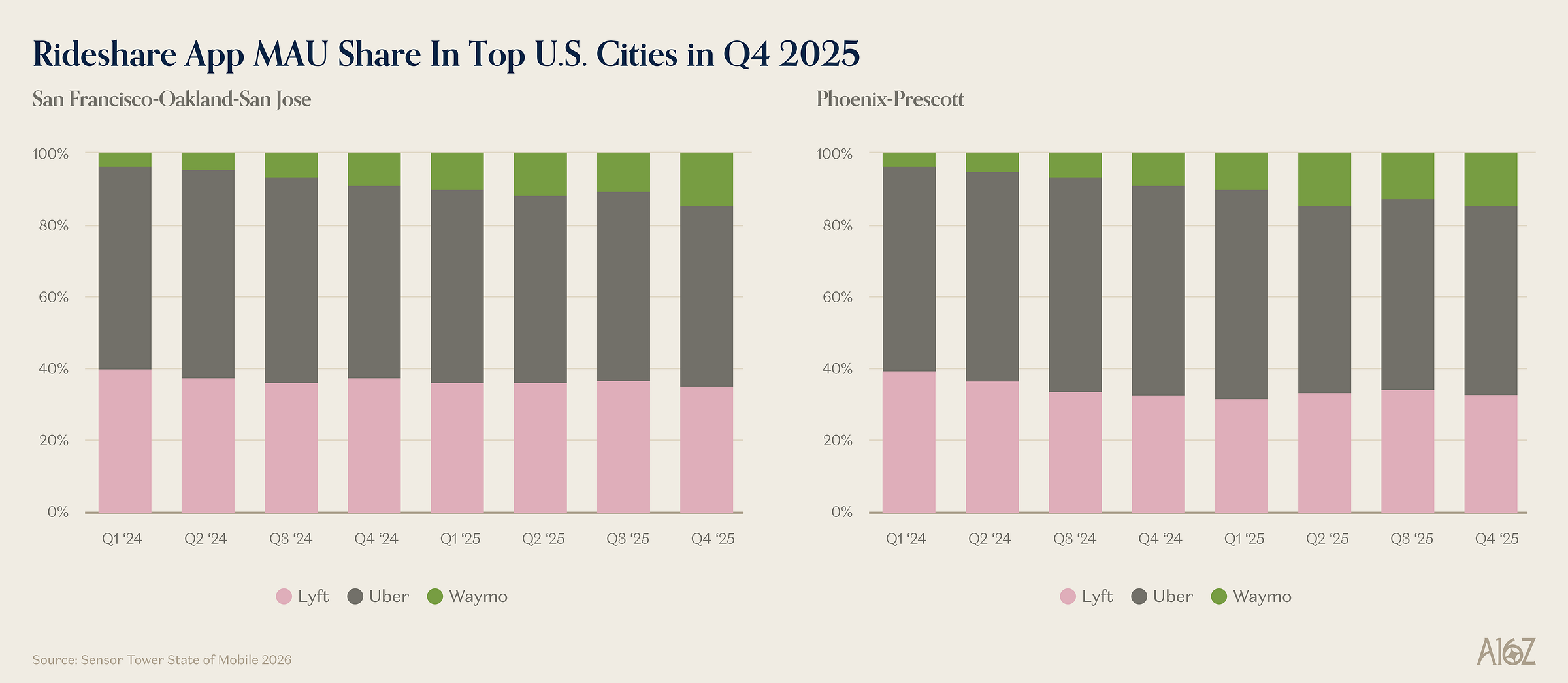

In markets where Waymo is active, marketshare is much more impressive:

Waymo’s share of rideshare MAUs has risen to ~15% in SF and Phoenix, despite operating in only parts of those cities.

Waymo reportedly has 127M miles of fully autonomous driving under its belt (“the equivalent of going to the moon and back over 260 times”) and tripled its annual volume to 15M rides in 2025.

The future of mobility is here, it’s just not evenly distributed (yet).

This newsletter is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. Furthermore, this content is not investment advice, nor is it intended for use by any investors or prospective investors in any a16z funds. This newsletter may link to other websites or contain other information obtained from third-party sources - a16z has not independently verified nor makes any representations about the current or enduring accuracy of such information. If this content includes third-party advertisements, a16z has not reviewed such advertisements and does not endorse any advertising content or related companies contained therein. Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z; visit https://a16z.com/investment-list/ for a full list of investments. Other important information can be found at a16z.com/disclosures. You’re receiving this newsletter since you opted in earlier; if you would like to opt out of future newsletters you may unsubscribe immediately.

Why wps.com appears in the list of Top 20 Gaming Websites by 2025 Visits?

Thank you for the reporting.